Bitcoin can liquidate $18B with 10% price gain as traders see $120K next

Cointelegraph

Aug 10, 2025 21:52:25

Key points:

Bitcoin tags new August highs as traders see BTC shorts getting punished.

An early retracement could well turn into a trip to $120,000, predictions say.

A CME gap at $116,500 is of interest as a possible next local low.

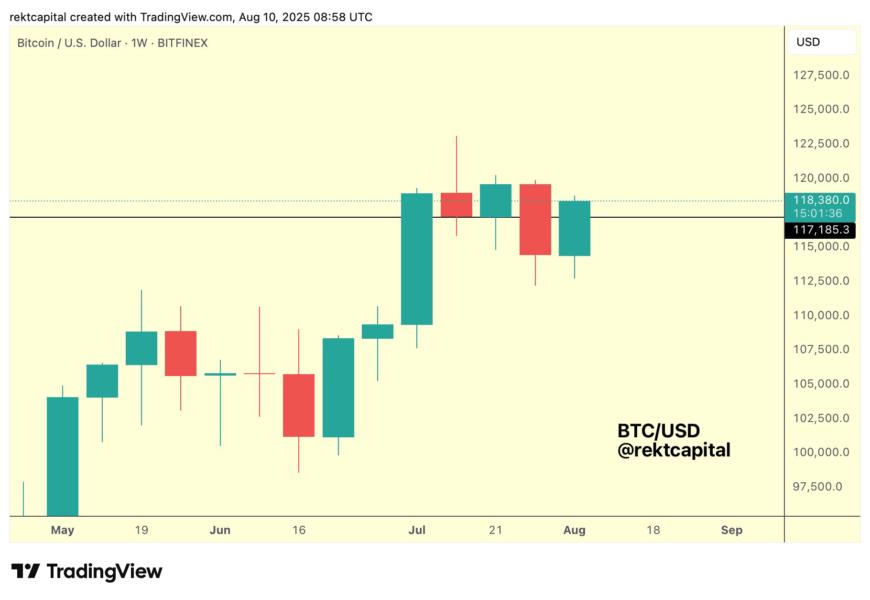

Bitcoin neared $119,000 into Sunday’s “decisive” weekly close as traders expected a strong week.

Bitcoin traders brace for giant short squeeze

Data from Cointelegraph Markets Pro and TradingView showed reaching $118,760 on Bitstamp, marking new August highs.

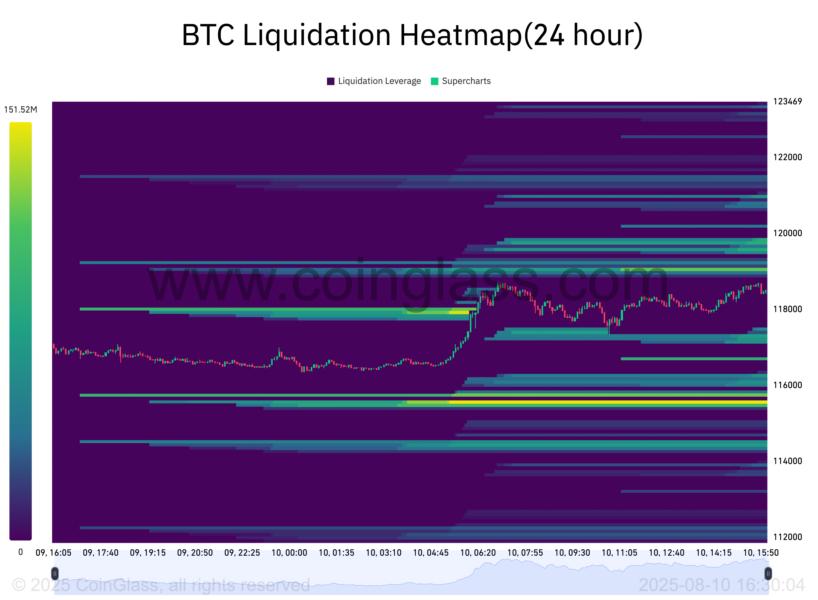

“Out-of-hours” weekend trading saw heightened liquidations, with the 24-hour crypto total at $350 million, per data from monitoring resource CoinGlass.

Commenting on market structure, crypto forecasts favored further progress into the new week.

“BTC is on the cusp of a reclaiming ~$117200 back into support,” popular trader and analyst Rekt Capital wrote in his latest X post about the weekly chart.

“Bitcoin is hours away from a decisive Weekly Close.”

Popular trader BitBull said that while weekend price moves can typically reverse as TradFi markets reopen, there was hope for new all-time highs next.

“Just a 10% upward move will cause $18B+ in short liquidations and big money is probably watching it,” he suggested about liquidity conditions.

“My guess is that Monday could be a bit bearish with BTC retracing its weekend pump. After that, we could see a move above $120,000.”

An accompanying chart compared now to previous bull markets to support the breakout thesis.

Fellow trader Merlijn agreed on the $120,000 target based on a potential short squeeze.

$BTC's next move: $120,000

The largest liquidity pool in weeks is sitting right above us.

If you’re short here… God help you.

SHORT SQUEEZE LOADING. pic.twitter.com/VXmExKH3jj

BTC price CME gap at $116,500 on the radar

Considering where the next BTC price dip might reverse, meanwhile, crypto investor and entrepreneur Ted Pillows suggested that price action would continue to coincide with “gaps” in CME Group’s Bitcoin futures market.

“There's a CME gap around $116.5K, which will most likely be filled,” he summarized in part of an X post.

“This week, BTC dropped $2K to fill last week's CME Gap. After that, Bitcoin could rally towards a new ATH.”

Trader Daan Crypto Trades nonetheless described the weekend’s moves as “choppy” rather than trending.

“Most focus is on $ETH breaking its cycle highs and alts making all kind of moves,” he argued, referring to the largest altcoin Ether , which hit multiyear highs.

“Would assume BTC takes the spotlight again for a bit the moment it breaks $120K+ and gets close to its own all time high again.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Latest News

The Block

Aug 11, 2025 07:25:56

Cointelegraph

Aug 11, 2025 06:09:24

NewsBTC

Aug 11, 2025 04:00:54

Cointelegraph

Aug 11, 2025 03:45:49

The Block

Aug 11, 2025 02:45:20