Is $30 XRP price a real possibility for this bull cycle?

Cointelegraph

Aug 12, 2025 20:03:20

Key takeaways:

One market analyst projects XRP could climb toward $34 this bull cycle.

XRPL’s $190 billion market cap versus $85 million TVL keeps overvaluation risks in play.

XRP has rallied by over 550% since November to over $3 on Tuesday. The cryptocurrency’s sharp gains have prompted technical analyst Gert van Lagen to predict a broader uptrend toward $34 this bull cycle.

Is it realistic for XRP to hit $30 and higher levels? Let’s take a closer look.

XRP’s double bottom hints at 10x gains

XRP has broken out of a seven-year double-bottom structure after rising above its neckline near $1.80, according to Van Lagen.

The cryptocurrency then pulled back to the neckline, which acted as support. In chart terms, such a retest often signals that the breakout is strong and traders are confident in higher prices.

Using the 2.00 Fibonacci extension of the pattern, Van Lagen’s measured-move projection points to a $34 target by mid-2026.

The setup mirrors XRP’s 2014–2017 price action, when a similar multi-year base resolved into a parabolic rally, pushing over 100,000% higher.

XRP’s markets have witnessed such outsized moves in recent years. For instance, it gained roughly 1,072% since the 2022 lows. Before that, in 2020-2021, XRP price soared by over 1,625%.

XRP’s 2020–21 rally largely took cues from a near-zero interest rate environment in the US. Its 2022–25 gains were mainly fueled by progress in the Ripple lawsuit, growing legal clarity, exchange relistings, and ETF optimism.

The latter continues to guide XRP bulls in 2025 with 95% odds of a spot ETF approval and forecasts suggesting the token could rally toward $27 if the green light comes, close to Van Lagen’s target.

XRP Ledger metrics flash overvaluation risks

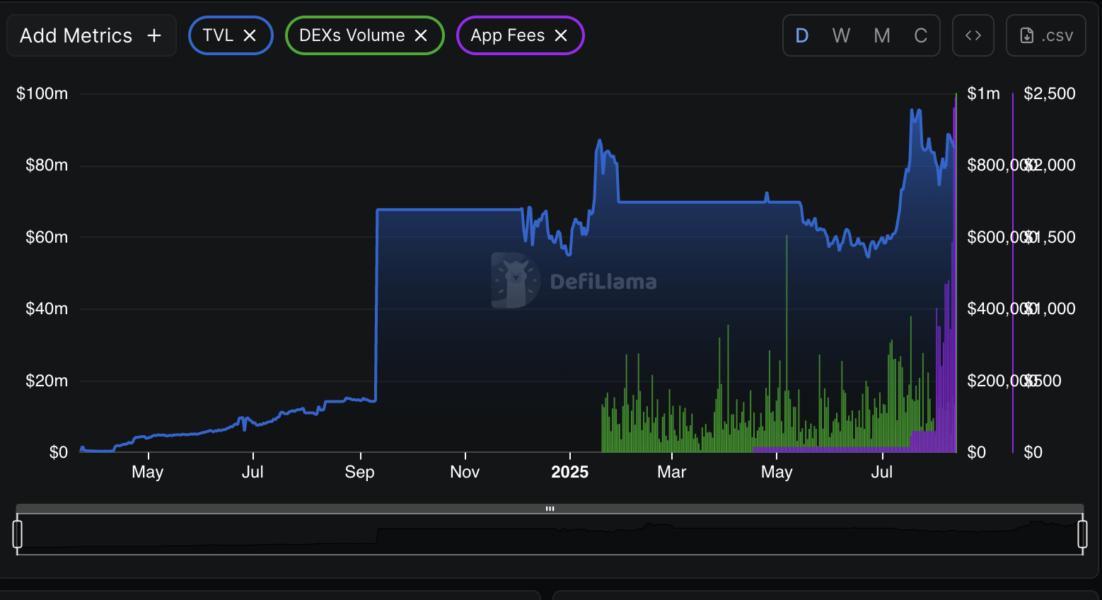

The growth of XRP’s parent chain, XRP Ledger (XRPL), lags far behind other major Layer-1s, including Ethereum, according to DefiLlama.

Its $190 billion market cap is roughly 2,200 times larger than its $85 million total-value-locked (TVL). That’s a stark contrast to Ethereum’s ratio of about 5.6, despite XRP’s valuation being nearly 40% of the latter’s.

Such a disparity has led to concerns over XRP’s extreme overvaluation relative to onchain activity.

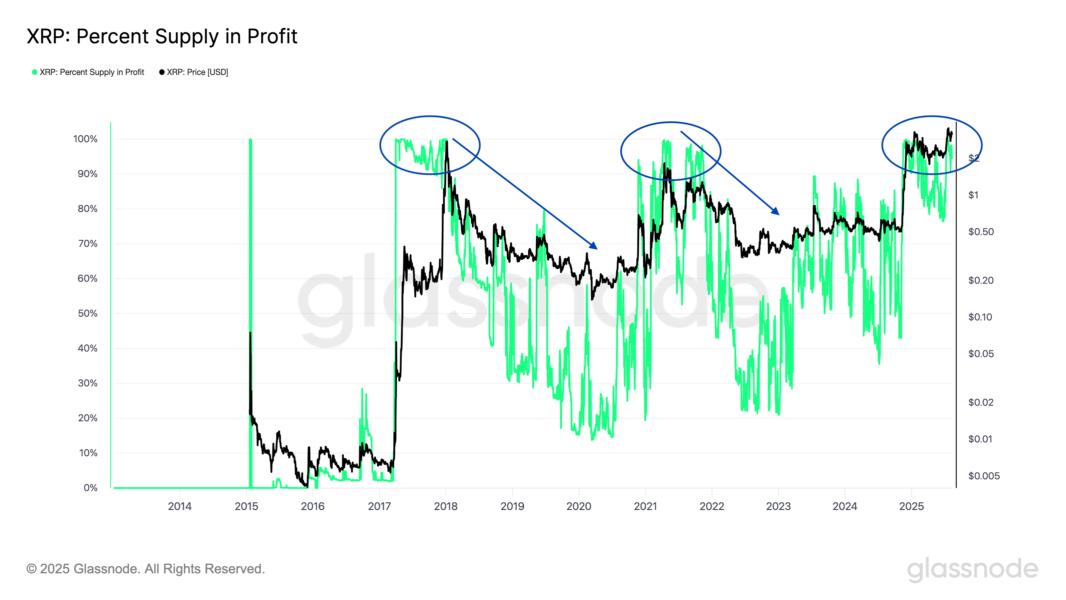

As of August, over 95% of XRP’s supply is in profit, a threshold that, during the 2020–21 and 2022–25 rallies, consistently preceded sharp price corrections, as shown in the Glassnode chart below.

When such a large share of holders sit on gains, profit-taking typically accelerates, creating sell pressure. Such a dynamic could challenge XRP’s ability to sustain its current uptrend toward $30.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Latest News

CryptoPotato

Aug 23, 2025 22:16:11

Cointelegraph

Aug 23, 2025 21:30:00

Cointelegraph

Aug 23, 2025 21:30:00

Coinpedia

Aug 23, 2025 21:28:45

Coinpedia

Aug 23, 2025 21:04:39