Bitcoin price dip hinges on $114K as markets shrug off US-EU trade deal

Cointelegraph

Aug 21, 2025 23:21:28

Key points:

Bitcoin has a new make-or-break price point to monitor into the weekly close: $114,000.

Bid liquidity lines up below local lows as BTC market structure risks looking “weak.”

Fed rate-cut odds fall for September despite a US-EU trade deal.

Bitcoin saw volatility at Thursday’s Wall Street open as markets digested a US-EU trade deal.

Bitcoin analyst flags key BTC price level

Data from Cointelegraph Markets Pro and TradingView showed ranging up to the $114,000 mark.

That level continued to act as short-term resistance, with bulls appearing stuck as even macroeconomic news brought little signs of trend change.

“Bitcoin is clearly rejecting from ~$114k resistance on the Daily timeframe,” popular trader and analyst Rekt Capital summarized in one of his latest X posts.

The day prior, Rekt Capital said that further BTC price downside depended on losing $114,000 “convincingly,” with the weekly close relative to that price level also important.

#BTC

This is the price action to watch in the short-term

Bitcoin needs to continue rejecting from $114k to enter downside continuation

After all, $114k needs to be convincingly lost for BTC to go lower

Weekly Close relative to $114k will also be key$BTC #Crypto #Bitcoin https://t.co/6Yubx4CqHd pic.twitter.com/VfJicvzqjf

Fellow trader Daan Crypto Trades identified an “interesting” area for a local low between around $109,850 and $111,900.

“Anything lower and I think the structure is going to be looking a bit weak,” he told X followers on the day.

“Generally you don't want to see price move back into such a large range/consolidation period after breaking out of it.”

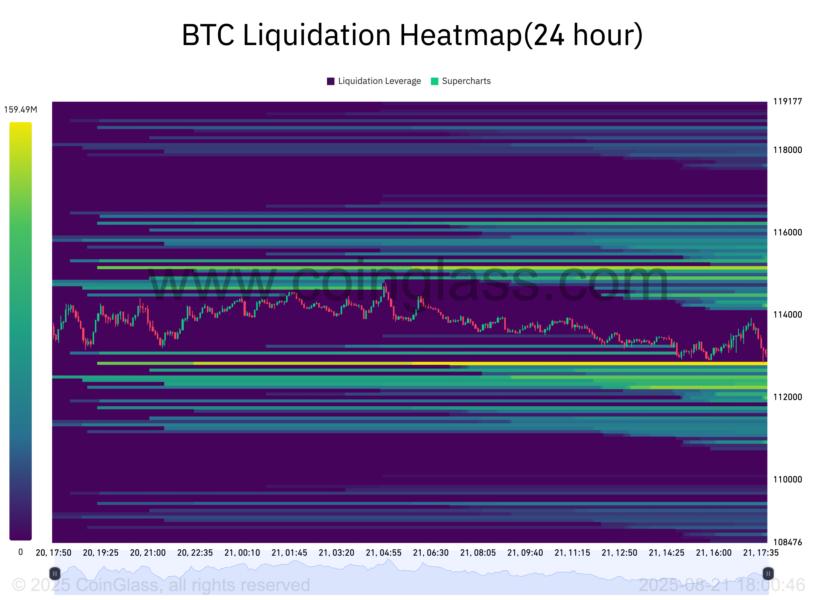

Exchange order-book data from CoinGlass showed the day’s lows coinciding with a band of bid liquidity beginning at $112,900.

Uncertainty reigns ahead of Jackson Hole

The trade deal, meanwhile, had little impact on US stock markets, with both the S&P 500 and Nasdaq Composite Index ranging after the open.

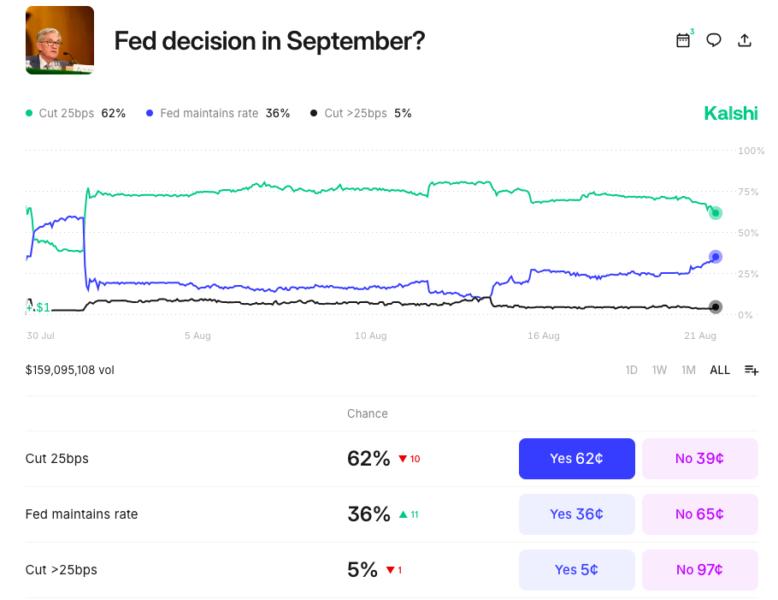

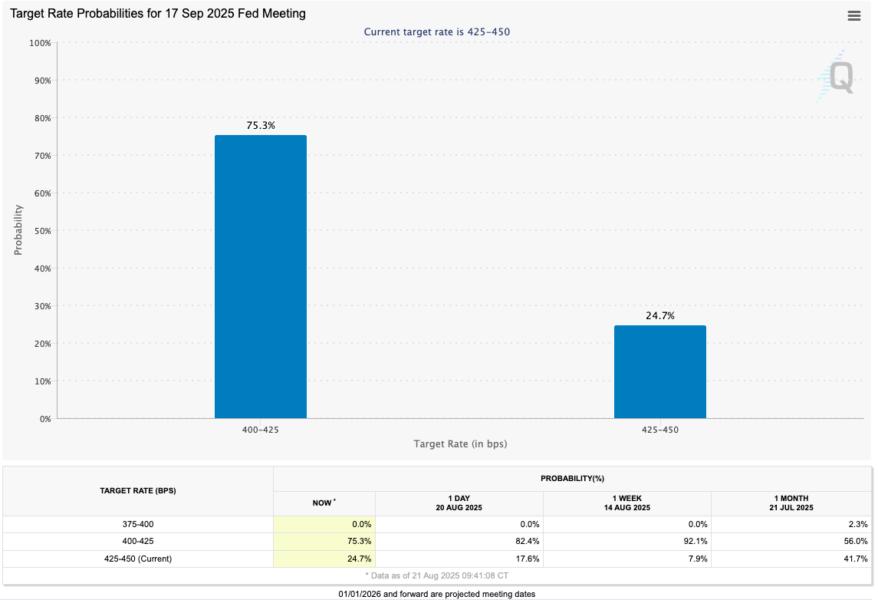

Ahead of the Federal Reserve’s Jackson Hole economic symposium, bets on interest-rate cuts at its September meeting deteriorated on the day.

The odds of no cut coming rose to 36% on prediction service Kalshi — the most since Aug. 1, trading resource The Kobeissi Letter noted.

Data from CME Group’s FedWatch Tool was more optimistic, giving 25% odds of rates being held at current levels.

“Minutes of the Federal Reserve’s last rate-setting meeting showed a broadening consensus over risks to the inflation outlook. The minutes noted that the majority of FOMC members saw upside to inflation outweighing employment risk,” trading firm Mosaic Asset wrote in an update Thursday.

Mosaic said that Friday’s Jackson Hole speech by Fed Chair Jerome Powell was “highly anticipated.”

“Powell has used the venue in previous years to broadcast key pivots on monetary policy,” it acknowledged.

“If concerns over inflation continue to outweigh risks to the labor market, Powell could temper expectations for any rate cuts at upcoming meetings until more data is gathered.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Latest News

Cointelegraph

Aug 22, 2025 10:28:23

Cointelegraph

Aug 22, 2025 09:36:19

MarketWatch

Aug 22, 2025 08:48:00

Dow Jones Newswires

Aug 22, 2025 08:00:00

Cointelegraph

Aug 22, 2025 07:38:15