How to rent an apartment in Dubai using Bitcoin (step-by-step)

Cointelegraph

Aug 22, 2025 20:04:26

Key takeaways Dubai’s clear rules now let tenants rent apartments with Bitcoin through approved channels. Risks like volatility and landlord limits are managed with AED locks and licensed platforms. Fast payments and low fees make Bitcoin real estate in Dubai increasingly appealing. Risks remain around Bitcoin’s price volatility and limited landlord acceptance, but AED price locks and regulated intermediaries help reduce exposure. Dubai is one of the few places where renting a home with cryptocurrency isn’t out of the ordinary. As a matter of fact, in 2025, the emirate is positioning itself as a global leader in crypto innovation, with clear rules set by the Dubai Land Department (DLD), the Virtual Assets Regulatory Authority (VARA) and the Central Bank of the UAE (CBUAE). VARA now licenses crypto service providers, from trading apps to custodians, while the DLD insists all official property records and leases be denominated in UAE dirhams. That means when you rent an apartment in Dubai with Bitcoin, the crypto is converted into AED through a VARA‑ or CBUAE‑approved provider. This regulatory clarity has given Bitcoin utility as a practical payment option for housing. Long‑term residents and newcomers can now pay Dubai rent using Bitcoin, stay compliant with Anti‑Money Laundering (AML) rules and handle lease settlements quickly. This guide walks you through the step‑by‑step crypto rental process in Dubai, from understanding regulations to finding Bitcoin‑friendly landlords in Dubai. Did you know? Property Finder UAE recorded a 50% rise in crypto-related property inquiries in 2024 compared to 2023.

Crypto rental process in UAE

By mid‑2025, Dubai had become one of the most forward‑looking frameworks for crypto in real estate anywhere in the world. VARA licenses every crypto payment processor, custodian and platform, enforcing strict compliance under its Asset‑Referenced Virtual Assets regime.

The Central Bank of the UAE adds another layer by requiring all stablecoin‑based property transactions (including rent) to go through licensed entities. Full Know Your Customer (KYC) and AML checks will be mandatory for these payments starting August 2025.

The DLD’s role is pivotal: All property deeds and rental contracts must be recorded in AED. This doesn’t block Bitcoin payments, but it does mean every transaction must flow through an approved crypto‑to‑dirham conversion channel before a lease is finalized.

While still niche, crypto in real estate is gaining ground. Around 3% of off‑plan property transactions in early 2025 were settled in cryptocurrency, mainly driven by overseas investors looking for faster, lower‑cost settlement. That same infrastructure now makes it possible to use Bitcoin for Dubai apartment rental.

Meanwhile, innovation is accelerating. The DLD, VARA and Dubai Future Foundation launched “Prypco Mint,” a tokenization platform built on the XRP Ledger that allows fractional ownership of properties. Initial offerings sold out almost instantly.

Taken together, VARA licensing, the fiat‑only deed mandate and new tokenization tools create a clear, legal path for Bitcoin to flow into AED and into Dubai’s housing market.

Did you know? Prypco Mint sold out a 788,000-AED villa in Dubailand in just five minutes, distributing fractional shares to 169 international investors.

Step-by-step crypto rental guide in Dubai

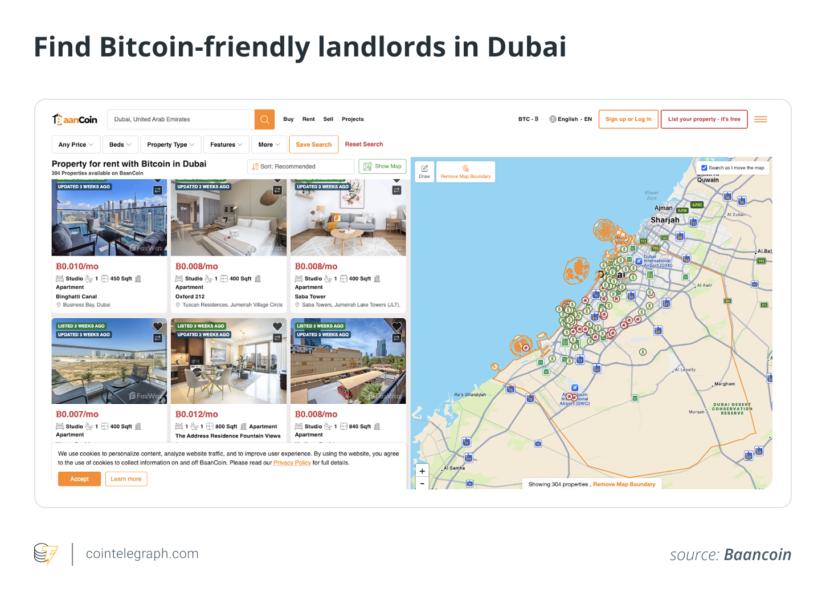

1. Find Bitcoin-friendly landlords in Dubai

Start by looking for apartments that openly accept Bitcoin. Platforms like BaanCoin now list more than 220 rental apartments in Dubai, including studios and one‑bedrooms in Business Bay, Downtown, the Marina and JVC — typically priced between 0.007 BTC and 0.022 BTC per month.

Mainstream real estate portals like Property Finder or Bayut can also help. They feature official DLD‑approved listings and often partner with agents who accept Bitcoin indirectly.

Using filters or searching for “crypto‑friendly” tags is one of the simplest ways to spot Bitcoin‑friendly landlords in Dubai and take the first step toward using Bitcoin for Dubai apartment rental.

2. Work with established agencies

If browsing listings isn’t enough, reach out to agencies that specialize in crypto.

Paragon Properties, for example, partners with big developers such as Emaar, Damac and Nakheel, offering Bitcoin, Ether (ETH), Tether USDt (USDT) and other digital asset options for both rentals and purchases.

Crypto Properties Agency, featured on Bayut, focuses on real estate crypto payments in Dubai and also works directly with established brokers and developers.

These agencies simplify the crypto rental process in the UAE by handling the legal and technical side of crypto‑to‑dirham conversions.

3. Contact the agency or landlord and clarify terms

Once you’ve found an apartment, confirm Bitcoin is accepted and settle the important details:

Rent must be stated in AED (even if it’s paid in BTC)

Agree on the conversion rate and how often it’s updated

Decide if rent will be paid monthly or quarterly

Spell out refund terms, late payment rules and how crypto volatility is handled.

Having these terms written into the lease is essential for a smooth step‑by‑step crypto rental in Dubai.

4. Use licensed payment processors

Under UAE law, any Bitcoin‑to‑AED transaction must go through a VARA‑licensed or central bank‑approved processor. Options include Rain, Binance UAE, Hayvn, CryptoProcessing.com and Coop Escrow. Using such providers ensures AML/KYC compliance and keeps your rental contract valid with the DLD.

5. Complete compliance checks

Expect to go through standard AML/KYC protocols: identity verification, proof of funds and wallet checks. UAE regulators require these even for rentals, and skipping them isn’t an option if you want your lease to be valid.

6. Execute payment and sign the lease

Transfer the Bitcoin via your chosen processor. It’s instantly converted to AED, and the landlord receives the dirham payment. Once complete, you’ll sign your rental agreement (digitally or on paper) and receive an AED‑denominated receipt that notes the payment originated from crypto.

7. Register if needed

For most long‑term rentals, DLD registration isn’t mandatory. Short‑term stays, especially those booked via hospitality platforms, might require it. Keep all AED payment documentation — this could be useful for visa or housing verification later.

Benefits of paying Dubai rent using Bitcoin

Many are willing to look past some of the risks associated with renting in Dubai with Bitcoin due to its unique advantages.

Settlement times

Traditional bank transfers (especially international ones) can take days to clear. By contrast, Bitcoin payments are confirmed within minutes. For global renters who need quick, frictionless fund transfers, this speed eliminates the delays of escrow or bank intermediaries and makes living in Dubai with Bitcoin easy.

Transaction costs

Sending rent through crypto is often far cheaper. Typical crypto settlement fees are under 1%, compared to 2%-5% for cross‑border bank transfers or foreign exchange conversions. Over the course of a year, those savings add up, benefiting both tenants and Bitcoin‑friendly landlords in Dubai.

Global accessibility

Not every expat moving to Dubai has a UAE bank account. Using Bitcoin for Dubai apartment rental sidesteps that problem entirely. Tenants can transfer funds from anywhere in the world without the hassle of opening local accounts or managing complex currency conversions, making the market more open to international residents.

Greater transparency and auditability

Every crypto payment leaves a clear, timestamped record on the blockchain. That means amounts, exchange rates and payment dates are fully verifiable, supporting dispute resolution, regulatory compliance and trust between tenant and landlord. This transparency is one reason real estate crypto payments in Dubai are gaining traction.

Did you know? According to the Henley & Partners Crypto Wealth Report, 30% of Dubai’s ultra-high-net-worth individuals held cryptocurrency assets in 2025, driving luxury real estate demand via Bitcoin payments.

Rent apartment in Dubai with Bitcoin: Risks and mitigation

There are still a few risks that one should consider before renting an apartment in Dubai with Bitcoin.

Volatility

Bitcoin’s price swings can impact your rent if you agree to pay directly in BTC. A sudden drop or spike before conversion could change the AED value you owe. To avoid surprises, most tenants fix the rent in AED and either lock the rate at signing or use stablecoins like USDT or USDC (USDC) to keep the value steady.

Unlicensed providers and platform risks

Only deal with VARA‑licensed or central bank‑approved services: Rain, Binance UAE, Hayvn or CryptoProcessing. Using unregulated exchanges can lead to fraud, lost funds or even invalidation of your rental contract since the DLD only recognizes AED payments from approved channels.

Limited landlord acceptance

Crypto rentals are still a small slice of the market. Surveys show only about 3% of landlords are open to Bitcoin payments for housing, meaning you may have to rely on niche agencies or listings that explicitly advertise crypto options.

Regulatory developments

Dubai’s framework is strong but still evolving. After August 2025, new KYC/AML rules for stablecoin payments or long‑term leases could appear. Staying updated with VARA and the central bank (and being ready to adjust your lease terms if laws change) is essential for anyone planning to pay rent in Dubai using Bitcoin long‑term.

Use Bitcoin for a Dubai apartment rental in 2025

By mid‑2025, renting an apartment in Dubai with Bitcoin is practical, but it’s still a niche choice. Success hinges on working with crypto‑experienced agents or developers, such as Emaar, Damac, Nakheel or Engel & Völkers, or going through dedicated crypto‑property agencies. Always rely on VARA‑licensed or central bank‑approved payment processors for Bitcoin‑to‑AED conversions to keep everything compliant.

Every lease should spell out key details: the locked AED amount, how conversions are handled and dispute resolution terms. That level of clarity helps protect both tenant and landlord from volatility risk or misunderstandings.

Regulations are evolving, too. The central bank’s Payment Token Services Regulation (PTSR) is rolling out through 2025, tightening KYC/AML requirements for crypto and stablecoin payments. If those rules shift mid-lease, you may need to update terms or reverify your payment process.

Looking ahead, tokenized real estate projects (such as Prypco) hint at an even bigger future for crypto in housing. With Bitcoin real estate in Dubai moving from niche to mainstream, it’s getting easier than ever to pay Dubai rent using Bitcoin.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Latest News

Cointelegraph

Aug 22, 2025 21:22:22

CryptoPotato

Aug 22, 2025 21:17:26

CryptoPotato

Aug 22, 2025 21:08:47

Cointelegraph

Aug 22, 2025 21:02:36

Cointelegraph

Aug 22, 2025 20:15:31