“ETH MicroStrategy” SharpLink Trades Below NAV — Is Ethereum Bottoming Out?

Beincrypto

Aug 26, 2025 15:52:49

SharpLink, often dubbed the “ETH MicroStrategy,” is now trading below the value of the Ethereum it holds on its books.

This turnout fuels speculation of a major market turning point, delivering one of those rare signals traders wait years to see.

SharpLink’s NAV Discount Sparks Debate Over Ethereum’s True Bottom

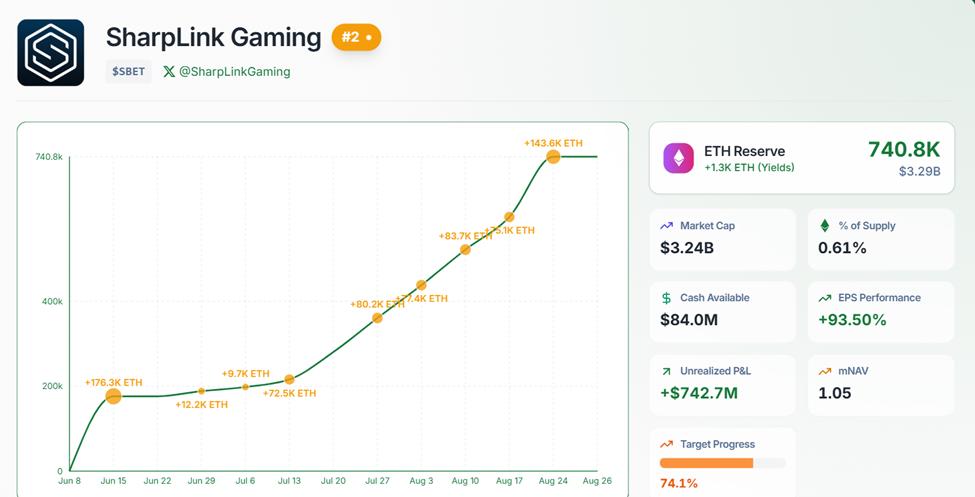

As of this writing, SharpLink’s total market capitalization is $3.24 billion, slightly below its Ethereum holdings, which are worth $3.29 billion.

Notably, this marks a rare discount, showing investors value the company at less than the assets it owns.

Crypto analyst AB Kuai Dong highlighted this anomalous condition. He explained that when Net Asset Value (NAV) falls below 1, it signals that the company’s equity trades at a discount to the ETH it controls.

“This also means that the overall market value of ETH MicroStrategy is lower than the value of the ETH assets on its books. The bottom-fishing reference line predicted by legendary traders has finally appeared this time,” Kuai Dong wrote on X.

For seasoned traders, such NAV discounts are rare and often interpreted as contrarian buy signals, suggesting capitulation may be near.

Analysts Eye Upside Targets Amid SharpLink’s Buyback Buzz and Retail Signals

Last week, SharpLink announced a $1.5 billion buyback program when its market cap hovered around $3.2 billion. This means a buyback intervention to rake in nearly half its outstanding value.

This news triggered a slight climb for its stock, SBET, which moved from $18 to $21 before slipping back to $19.17 as of this publication. At a structural level, the NAV ratio has become a trading compass.

“When mNAV > 1: swap stocks for coins. When mNAV < 1: buy back stocks…follow the treasury company’s moves,” an X user explained.

However, investors should conduct their own research, as sentiment also hinges on the Ethereum price action.

Elsewhere, Donald Dean highlighted SharpLink’s positioning as a compelling risk/reward bet. The economist projected aggressive upside targets if ETH rises.

In his NAV-linked model, SharpLink’s stock could reach $37.22 at ETH $4,600, $40.37 at ETH $5,000, and $48.28 at ETH $6,000.

Meanwhile, SharpLink itself doubled down on its ETH-first mission, revealing the pivot in a recent post.

“At SharpLink, we have two major goals: Raise capital to buy ETH and put that ETH to work to generate yield on behalf of shareholders,” the company articulated.

However, the strategy faces criticism, with some, such as crypto commentator Grubles, pointing out the opportunity cost of ETH staking.

“T-Bills yield more than ETH staking. So you’re leaving money on the table by staking ETH,” Grubles challenged.

For many in crypto, the SharpLink discount is less about corporate treasury mechanics and more about Ethereum’s long-awaited bottom.

Some traders see the NAV < 1 phenomenon as a line in the sand, where valuations disconnect from fundamentals before snapping back in bull cycles.

As of this writing, Ethereum was trading for $4,415, down by nearly 5% in the last 24 hours.

If ETH turns upward from here, the SharpLink NAV signal could be an early indicator, suggesting the start of a broader Ethereum-led market rebound.

Latest News

Cointelegraph

Aug 27, 2025 06:54:19

Cointelegraph

Aug 27, 2025 06:54:19

Cointelegraph

Aug 27, 2025 06:26:45

Cointelegraph

Aug 27, 2025 06:23:03

CoinMarketCal

Aug 27, 2025 06:00:19