Standard Chartered calls Ethereum and ETH treasury companies ‘cheap’ at current levels

The Block

Aug 27, 2025 02:25:14

Ethereum and companies holding ETH on their balance sheets are currently undervalued, according to Standard Chartered’s global head of digital assets research, Geoffrey Kendrick.

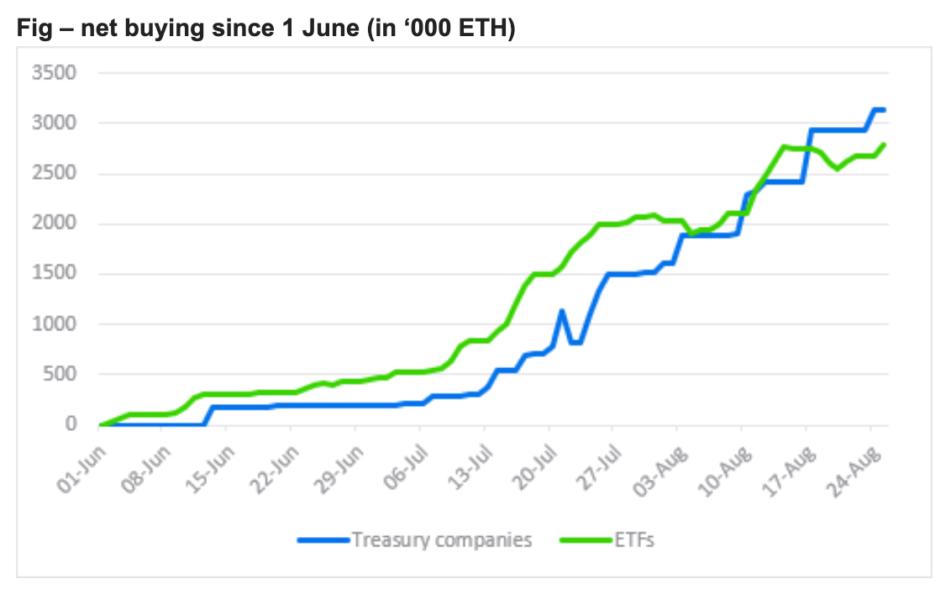

In a new note from Tuesday, Kendrick said Ethereum digital asset treasury (DAT) companies have so far bought 2.6% of all ether in circulation since June, while spot ETH exchange-traded funds (ETFs) added another 2.3% in the same period — meaning 4.9% of supply has been absorbed in less than three months.

That helped push ETH to a fresh all-time high of $4,955 on Aug. 24.

Still, Kendrick said ETH and the Ethereum treasury companies are "cheap at today’s levels,” reiterating his recent view that treasury firms could eventually hold 10% of circulating ETH. Ethereum DAT BitMine Immersion alone is targeting 5% of circulation, he noted.

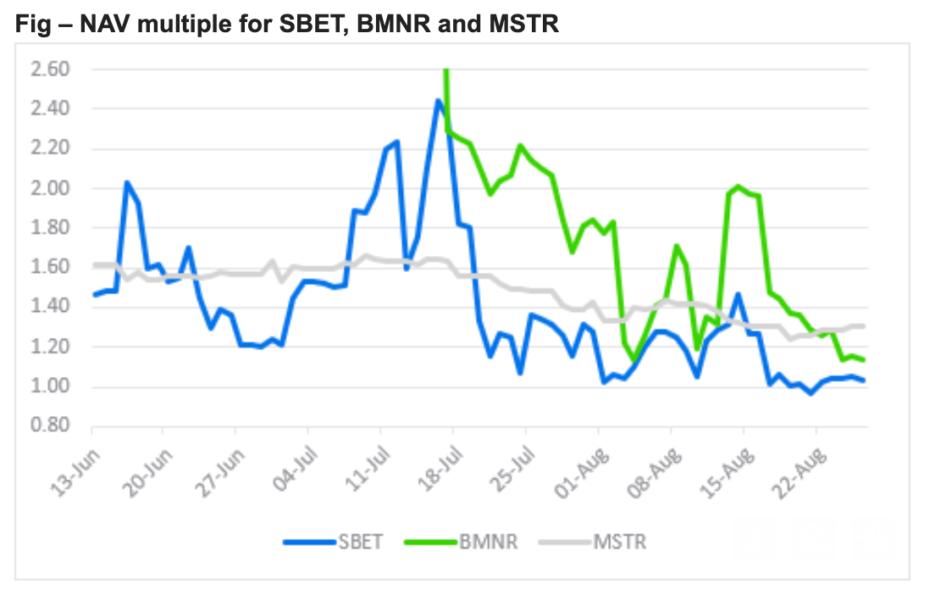

The Standard Chartered researcher brought attention to how the valuations of ETH treasury firms such as SharpLink Gaming (SBET) and BitMine Immersion (BMNR) have fallen below Strategy (MSTR) on a net asset value (NAV) multiples basis.

"Given that the ETH treasury companies are able to capture ETH’s 3% staking yield I see no reason for the NAV multiples to be below MSTR’s multiple (which captures no such staking yield)," Kendrick said.

SBET’s saying last week that it would repurchase shares if its NAV multiple falls below 1.0 should provide a “hard floor” for valuations, he added.

Earlier this month, Kendrick said Ethereum DATs are now “very investable,” as they present a stronger case for investors than U.S. spot ETFs, which currently cannot stake or participate in decentralized finance.

The researcher maintains a $7,500 price target for ETH by year-end and $25,000 by 2028, calling the recent sell-off “a great entry point.” ETH is currently trading at around $4,530, according to The Block's ETH price page.

Kendrick has been one of the more bullish voices across crypto. Last month, he raised his forecast for bitcoin to $135,000 by Sept. 30 and reiterated a $200,000 year-end target. His 2028 projection stands at $500,000.

Additionally, Kendrick expects BNB to reach $2,775 by 2028, Avalanche’s AVAX token to climb to $250 by 2029, and XRP to rise to $12.50 by 2028. He also forecasts stablecoin adoption to surge, with the total market approaching $2 trillion by the end of 2028.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Latest News

Cointelegraph

Aug 27, 2025 03:42:00

Coindar

Aug 27, 2025 03:34:50

Coindar

Aug 27, 2025 03:34:49

Coindar

Aug 27, 2025 03:33:45

Coindar

Aug 27, 2025 03:32:14