3 people who unexpectedly became crypto millionaires… and one who didn’t

Cointelegraph

Aug 27, 2025 21:30:00

A surprise manila folder with millions of Bitcoin, a memecoin that went to the moon and a series of high-stakes poker games these are some true-life tales of people who struck it rich with crypto.

While there are many stories of skilled traders, miners and gamers who became self-made crypto millionaires, the more interesting ones are those who stumbled into crypto and accidentally struck digital gold.

It was 2013. Two freshman students were sitting at a bar. The guy, a nerdy computer type, was interning at Goldman Sachs. He told the girl lets call her Anna You should invest in Bitcoin. The girl, who had the resources, said, Sure.

$10,000 was exchanged, and Anna forgot about it.

Fast-forward to graduation day. Her nerdy computer friend handed her a manila folder with the seed phrases, hard wallet and instructions to hold onto this for a very long time.

The hard wallet sat at her parents house until 2020, when Bitcoin rallied again. Around the same time, her husband got curious about crypto.

I said to him, This is so crazy, but I think I have something like that in my parents house, she tells Magazine.

That something was several million dollars worth of Bitcoin. And just like that, she was a multimillionaire at 25.

Many crypto rags-to-riches stories are about being in the right place at the right time. For people wanting to become crypto millionaires today, its all about the memecoins.

The average person is now having to fight institutions and corporate organizations for Bitcoin, and theres a finite amount, says Anna, who now works in the crypto industry. If you buy one Bitcoin at $100,000 or half at $50,000, youre still making money, but its not going to be that you invest $15 to $20 and make millions off it anymore.

I have a friend who invested in Fartcoin for a laugh, and it shot up. He didnt do any research on it at all but just hit a lucky token.

Making millions from memecoins

Metin Redjepi first learned about crypto in late 2016 when he was an inspector at the Ministry of Economy of the Republic of Macedonia. A colleague had told him about Bitcoin, but he was more intrigued by the notion of a new economic model rather than personal gains.

Redjepi went on to become the global head of community and chief operating officer at live streaming service DLive, which was an early adopter of blockchain technology. He made his first Bitcoin investment in 2017, when it was around $100,000. That same year, he made his first million from crypto.

Fascinated by crypto culture and online communities, Redjepi started looking at memecoins. People mostly focus on the technical analysis, which is valid, but I focus on the psychological factors, he said.

He dropped about $10,000 into three memecoins (PEPE, DOGE and WIF), which went on to 25-50x in value. He knew the frogcoin in particular had potential right from the beginning.

When I start to hear about something like that from non-crypto people, I know that itll go viral. The Pepe Frog is OG internet culture and a well-known meme. Its all about the vibes, community and timing, Redjepi said.

Redjepi launched his own memecoin in April 2024, on election night in Turkey, when a street interview went viral. An old person mispronounced the mayor of Istanbuls name during the election broadcast, saying Imaro instead of mamolu. Redjepi launched the IMARO coin that night, and it blew up.

IMARO hit a peak market cap of $8.5 million.

Launching a memecoin doesnt require much skill, but running it and understanding the sentiment of the community does. 98% of the memecoins die on the first day, he says.

Buying Bitcoin in 2012 and BNB in the 2017 ICO

Wesley, a 29-year-old high-stakes poker player, is another example of an alternative path to becoming fabulously wealthy with crypto.

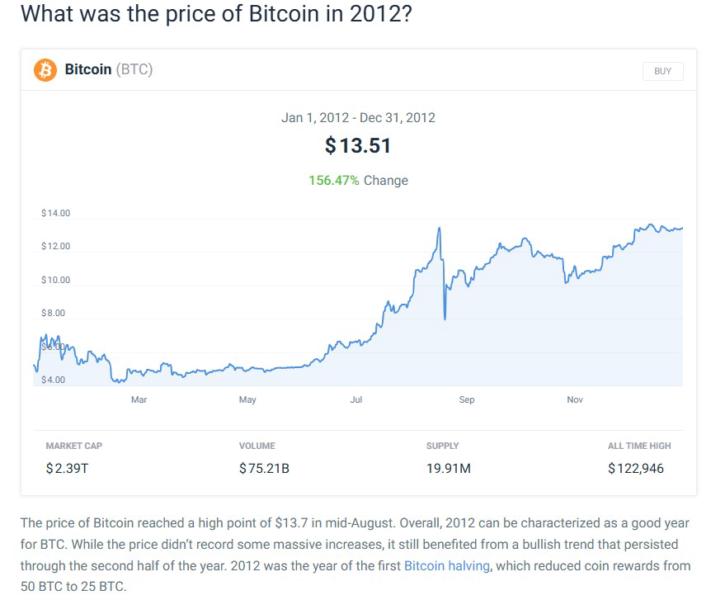

Back when he was still in high school in China, he was a gamer and needed money for equipment. He bought cheap gift cards from Paxful, then resold them on Taobao, the Chinese version of Amazon. He used the profits to buy Bitcoin in 2012.

He was 16 years old and got into the market long before the ICO boom but jumped on early-stage projects in 2017. His most successful investment was in Binance, and hes since made a few hundred thousand per coin.

Its luck and belief, he says of his good fortune. We got in early. Before 2020, up to 80% of Bitcoins trading volume and hashrate was in China, so we had so much advantage.

Read also Features

Raider investors are looting DAOs Nouns and Aragon share lessons learned

FeaturesDecentralized identity: Proving its really you in the 21st Century

Wesley started playing high-stakes poker in 2022, after losing millions from trading crypto. He sees similarities in both. It takes skill and mind control, Wesley said. Hes something of a stereotypical crypto millionaire now, flying on private jets to Vegas, partying on yachts and playing poker with celebrities and billionaires, such as MrBeast, Neymar, Jimmy Butler and Ryan Garcia.

I bought a Ferrari from Travis Scott for $2.8 million and sold it for $3.5 million, he says.

Cautionary tale: Never sell your Bitcoin for pizza

While some people turned an early brush with Bitcoin into multiple millions, many more cashed out with what seemed like big profits at the time.

Brian Huangs story serves as a cautionary tale. Huang first heard about crypto when he was a student at MIT in 2014.

MIT ran an experiment where they gave every student a third of a Bitcoin. It was worth about $100 at the time. Every undergrad was like, Hell, yeah, Im going to get a free $100 bucks for filling out a little survey. The goal was to see what people would do with digital currency, says Huang.

It was described to students as a digital currency, similar to what youd have in a game.

Unsurprisingly, most of the students traded it for pizza and beer. That survey would be worth about $40,000 today. Not millionaire status, but not bad for free money.

The sushi restaurant, pizza shop and bakery down the street all accepted Bitcoin because they knew some 4,000 students had access to it. They made it really easy. You would go to a sushi restaurant, scan a QR code and just send your money to that code. They capitalized on it in a way that even businesses havent done today. It was also a different time in terms of regulation.

Some of these local businesses may have had some foresight in thinking, This is going to be worth something one day. I think most of them sold, too, he explains.

Read also FeaturesMemecoin degeneracy is funding groundbreaking anti-aging research

Features Crypto traders fool themselves with price predictions: Peter BrandtWhile millionaires werent made, what did come out of the experiment was a cohort of students curious about crypto and many founders. There are so many great startups that first got exposed to Bitcoin back then.

Huang ended up holding his Bitcoin for two years. I sold it when it was about $1,000, so I had 10x my investment. I thought Id crushed it.

It was a wild time back then, he says, although he adds there are still opportunities today. I think were entering another interesting period with onchain stocks and things like that. There are some parallels.

Huang says theres a lot of untapped liquidity in Bitcoin, given its dominance across crypto. The ability to borrow against your Bitcoin positions in a permissionless way is going to be a huge unlock over the next year or two, he believes.

These self-made millionaires (and the cautionary tale) prove that in crypto, anything is possible. Even amid the turbulence of the past few years, crypto has minted more crypto millionaires than any other asset class with 172,300 individuals globally who hold over $1 million in crypto assets as of July 2024.

In the first half of 2025, more than 26,000 people became Bitcoin millionaires.

Subscribe The most engaging reads in blockchain. Delivered once a week.Email address

SUBSCRIBE

Latest News

Coindar

Aug 28, 2025 02:59:10

Coindar

Aug 28, 2025 02:59:09

Cointelegraph

Aug 28, 2025 02:38:23

CryptoPotato

Aug 28, 2025 02:32:29

Beincrypto

Aug 28, 2025 01:43:19