Arbitrum Season is approaching. Which projects' profit opportunities are worth paying attention to?

Sep 18, 2024 21:53:34

Original Title: DeFi Frameworks #007 - Arbitrum Edition

Original Author: THOR HARTVIGSEN

Original Compilation: Shenchao TechFlow

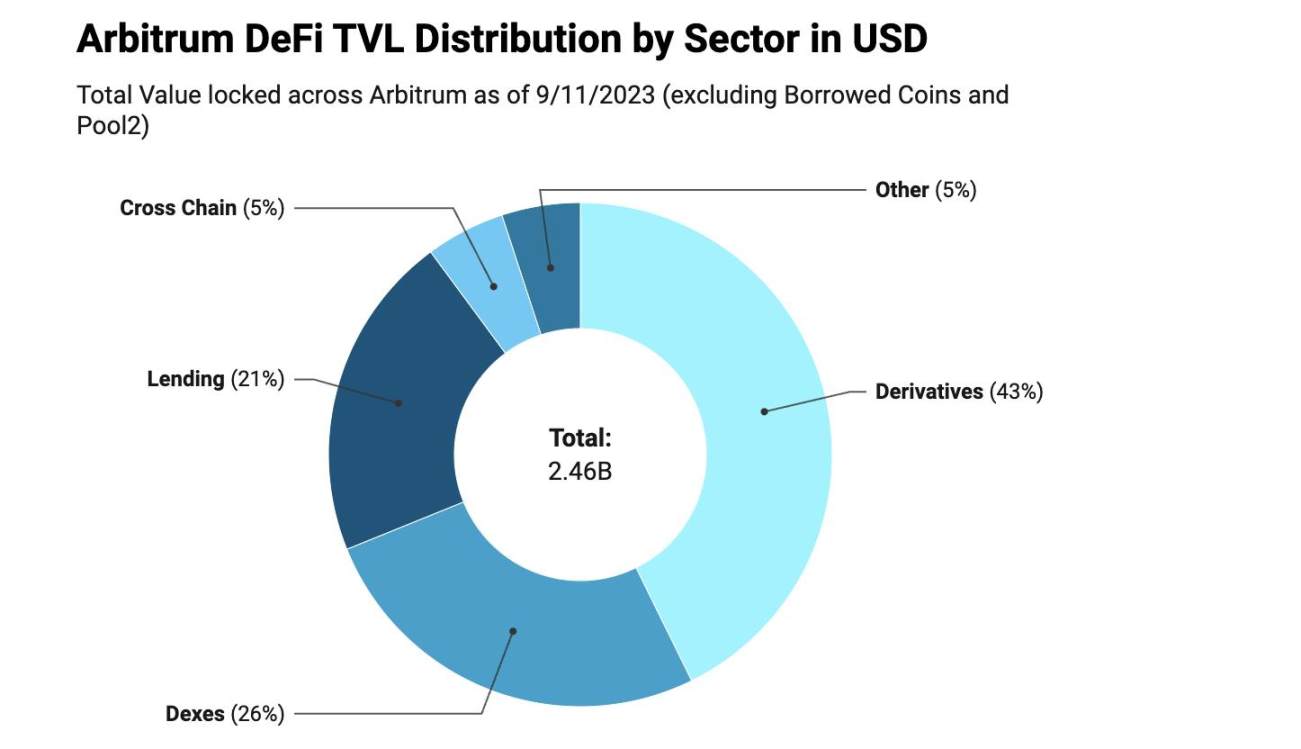

Most of Arbitrum's total locked value (TVL) revolves around trading protocols that leverage underlying technology to provide low fees and fast transaction processing. On Arbitrum, about 32% of the TVL is located in GMX, which is the most dominant platform on L2.

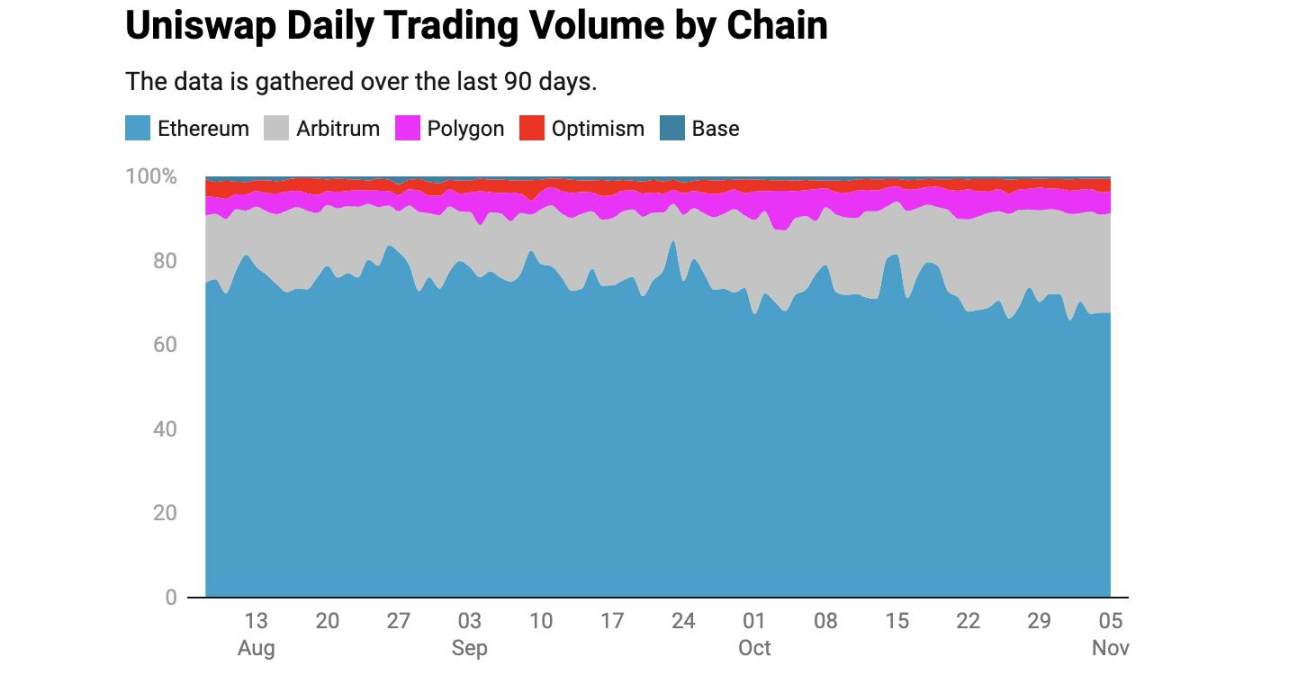

The trading volume distribution of Uniswap shows that the mainnet attracts most of the capital flow. However, the positive aspect of Arbitrum is that it is the platform with the highest transaction volume processed in Rollup.

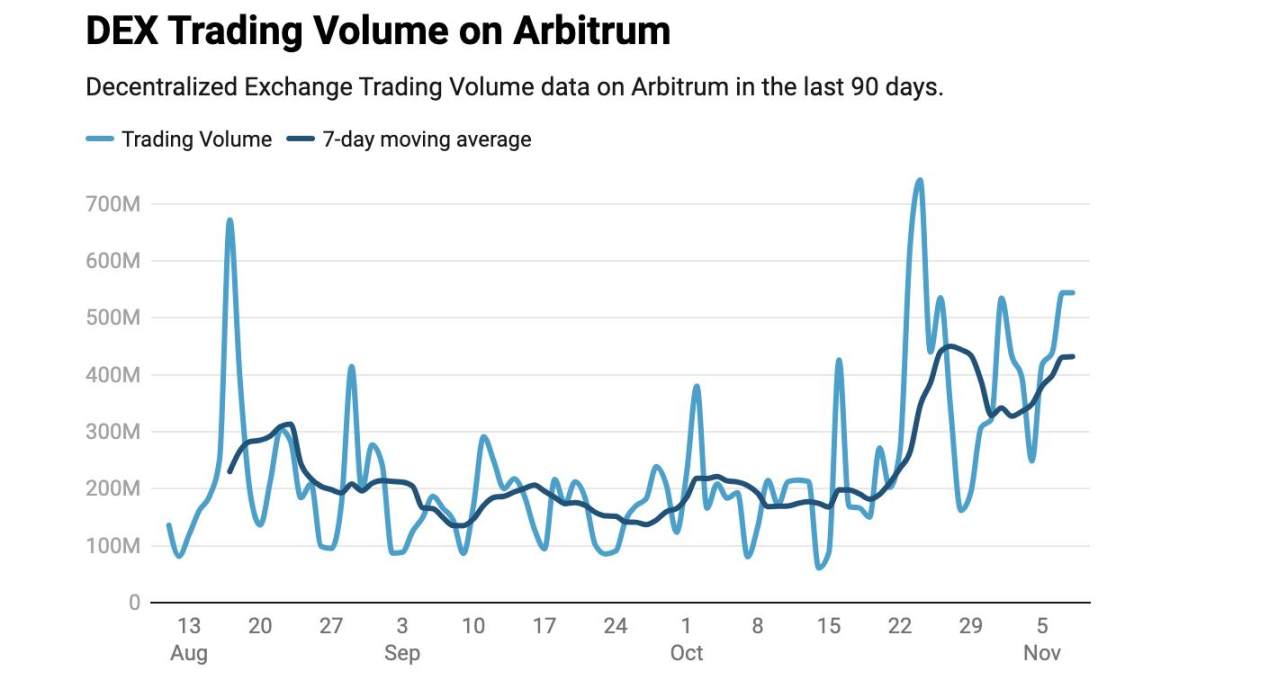

Given the general surge in trading volume and activity, it can be said that Arbitrum's prosperous season has arrived (at least for now).

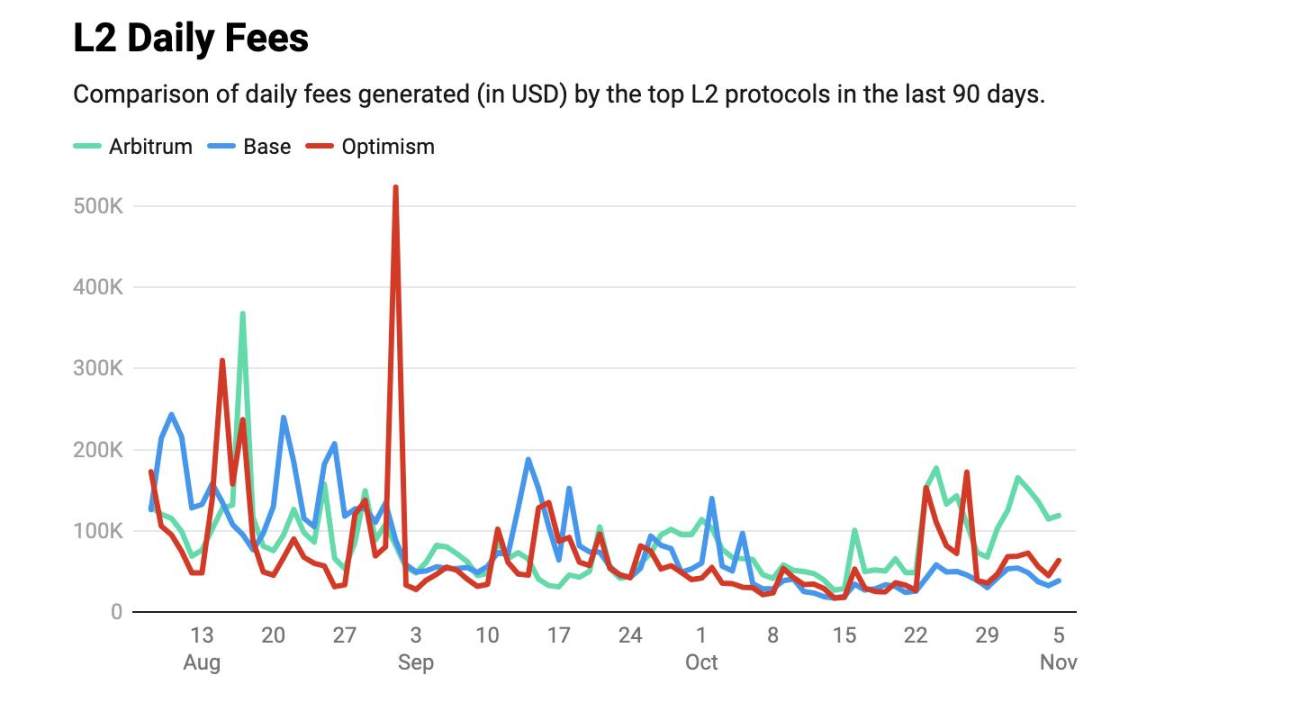

In terms of fee generation, Arbitrum has surpassed its peers after fierce competition for dominance among three parties. Despite the low fees, L2 has generated quite substantial revenue. A closer look reveals that Arbitrum seems to be the only Rollup with a significant upward trend in daily fees.

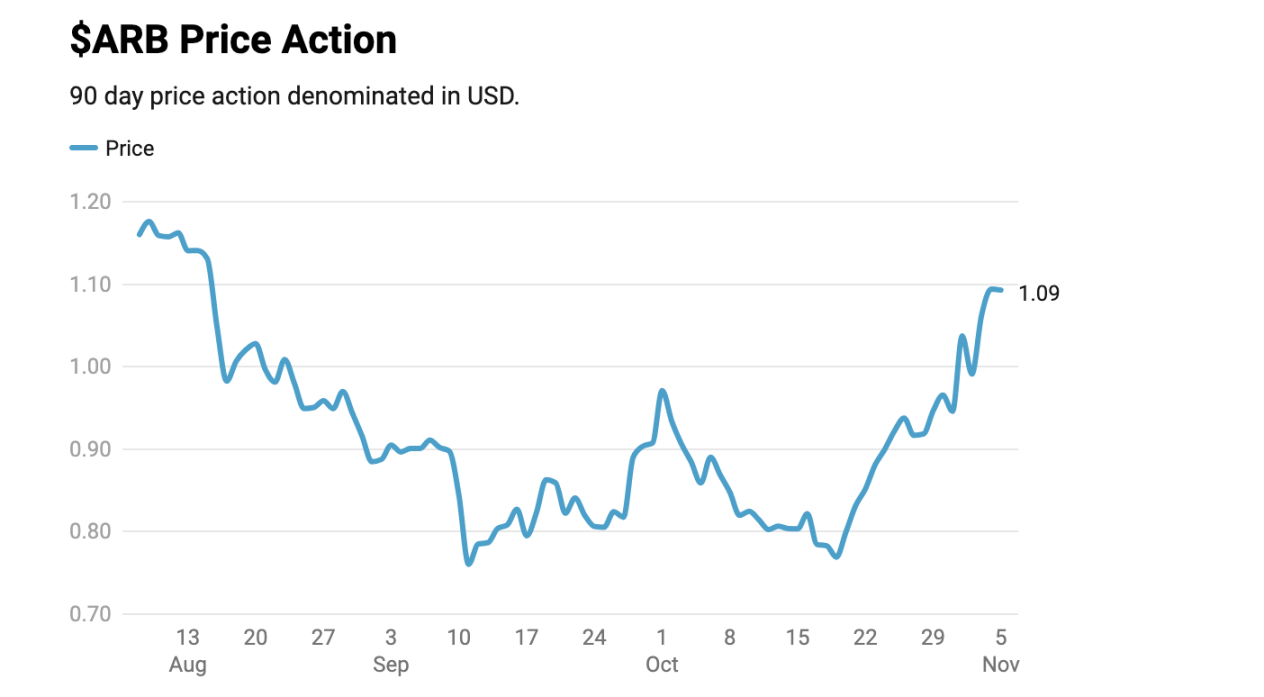

Arbitrum Token Performance

From the price trend, the Arbitrum token has shown an upward trend like other tokens in the market. Over the past three weeks, we have seen a clear double bottom and a market structure breakout at around $0.76 on the chart.

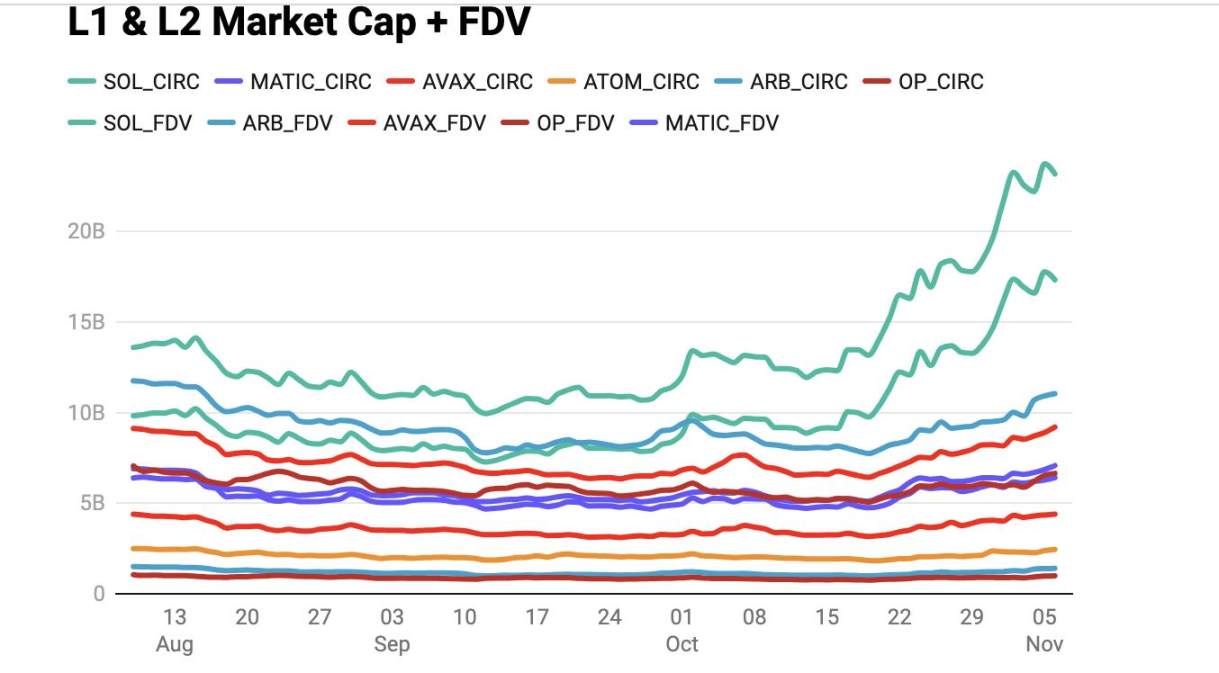

When looking at other L1 and L2, it is evident that, in terms of actual market capitalization (rather than fully diluted valuation), Arbitrum is still trading quite cheaply. However, it is worth noting that Arbitrum has the lowest market cap / fully diluted value ratio among all the projects shown in the chart below. Currently, about 13% of the total supply is in circulation, which is a relatively common phenomenon in today's cryptocurrency space. If buying pressure does not increase significantly, unlocking restrictions and/or additional token issuance may hinder the price performance of $ARB.

Is the Arbitrum Foundation Selling?

Despite outperforming its L2 peers, there are still those who believe that recent buyers are merely absorbing the selling pressure caused by the Arbitrum Foundation and the well-known market maker Wintermute. Dump Watcher reported in a brief tweet on Monday that they presented some interesting arguments to support this claim.

Since the ARB token was listed earlier this year, it has dropped about 60% from its all-time high of $1.80.

Arbitrum Staking

At the end of last month, the Arbitrum DAO proposed the introduction of unilateral Arbitrum staking. The staking contract will be funded by a certain percentage of the total supply, with the specific amount to be discussed.

The percentages and corresponding annual interest rate ranges are as follows:

- 1.75% of total supply (13.73% to 137.25%);

- 1.50% of total supply (11.76% to 117.65%);

- 1.25% of total supply (9.80% to 98.04%);

- 1.00% of total supply (7.84% to 78.43%);

- 0.00% of total supply ------ no funding for staking.

As of yesterday, the snapshot passed, with about 66% supporting the 1.00% funding option.

Why Propose This?

In addition to incentivizing holding, the motivation seems to be to increase interest in the Arbitrum ecosystem and its native token, surpassing other L2s while rewarding long-term investors. By utilizing the value of approximately $69 million in unclaimed airdrops, they do not need to draw too many tokens directly from reserves. Activating staking will further realize a combination around yield-bearing ARB tokens (e.g., liquid staking ARB) and will also take the first step toward introducing different forms of revenue sharing in the future.

What Impact Will This Have on Price Trends?

Following the official announcement, we can expect a price surge as many will seek to capitalize on the opportunity to lock tokens for yield. Inflation-based staking typically benefits short-term price action but may ultimately lead to selling pressure and dilution for non-stakers in the long run.

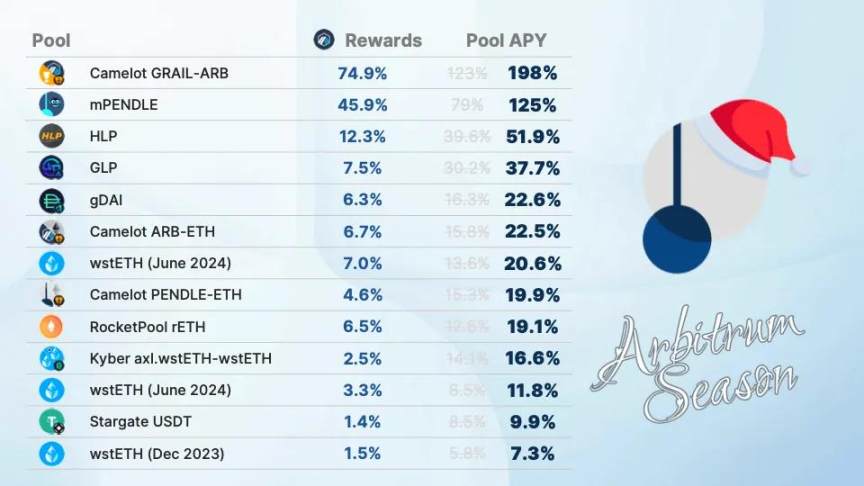

Incentives and Yield Opportunities

Thanks to the generosity of the Arbitrum Foundation, many projects funded by ARB tokens have fully utilized them, offering various incentives to maintain community engagement and increase user bases.

We will highlight some of the most attractive opportunities available on the list of funded projects.

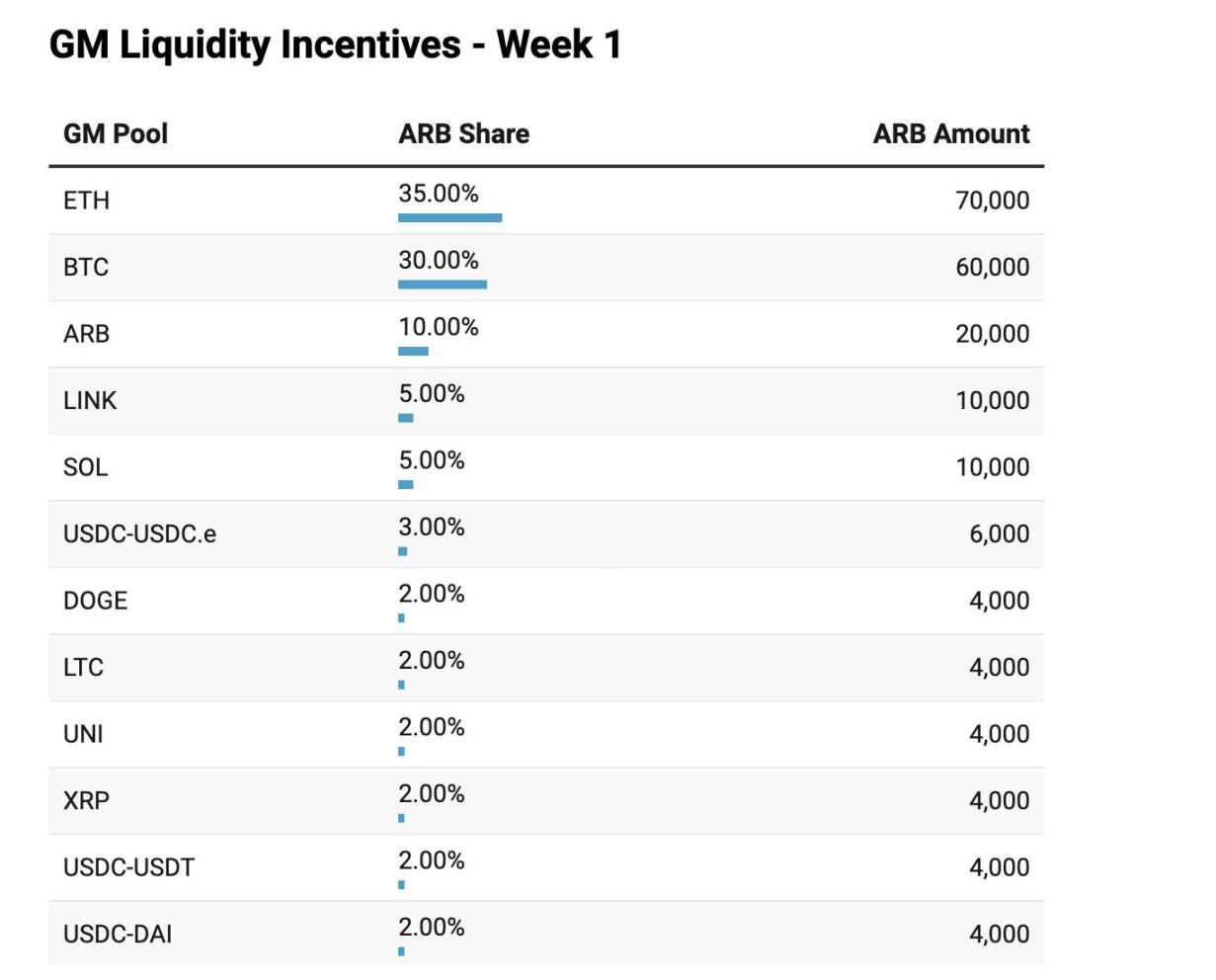

GMX

On November 8, GMX announced the launch of their 12 million ARB token distribution plan. Rewards can currently be earned by providing liquidity to various GM pools on the V2 platform. Additional incentives will be offered over the 12-week period for the migration from GLP to GM and for trading on the exchange. The token incentive distribution will be adjusted weekly and published in their Notion.

An additional 2 million ARB tokens will be used to provide funding rewards to developers and protocols building on GMX V2, further promoting the growth of Arbitrum. The GMX team will offer three different funding values to drive this work:

- Small Grants - budget up to $10,000;

- Public Grants - budget up to $100,000;

- Request for Proposals (RFP) - no set budget (case by case);

PENDLE

According to an announcement from the team on Medium two days ago, liquidity providers on the Pendle platform will be eligible for additional ARB rewards, in addition to their current earnings. Note that ARB rewards can actually be increased through vePENDLE. The distribution of reward tokens will be determined weekly by Pendle governance participants.

In addition to liquidity provision incentives, traders are now eligible for ARB fee discounts. A total of 26,500 ARB will be used weekly for the above discounts (the amount may be adjusted after a few weeks).

- Buying/Selling PT and YT, fees for entering and exiting LP will receive a 75% fee discount;

- ARB will be used to offset 75% of any fees paid for trades;

Once the weekly rewards are exhausted, one must wait until the reward stack is replenished.

An interactive dashboard specifically designed for this program will be launched on Pendle's website in about a week (November 16). The dashboard will include all relevant metrics related to the Arbitrum seasonal event.

Radiant

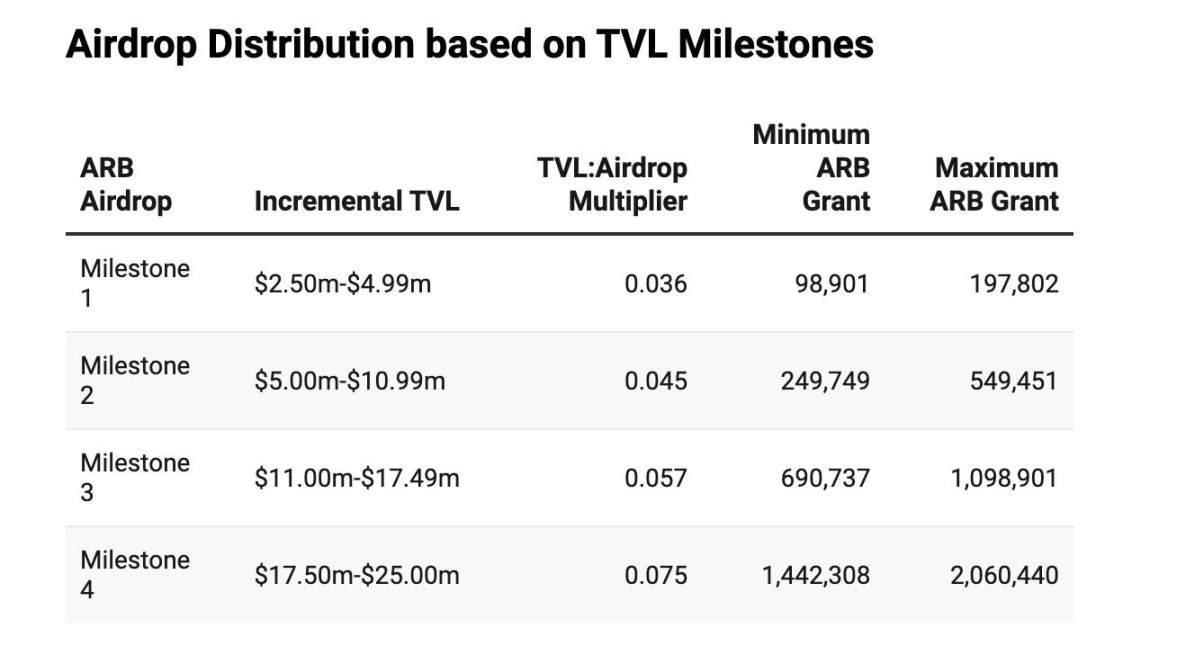

Approximately 72% of Radiant's strategic reserve of 2.8 million ARB tokens will be used for airdrops to depositors who lock their dLP for 6-12 months, spanning from block #147753665 to the next snapshot, which should take place in the next 30-90 days. Rewards are based on the TVL milestones proposed by Radiant.

Interactions on dLP with protocols like Magpie and PlutusDAO will also be eligible for rewards, although the final reward distribution will be determined by the respective protocols. The eligibility period for these rewards will end before January 31, 2024.

Related Projects

Latest News

Dec 02, 2025 03:00:09

Dec 02, 2025 03:00:07

Dec 02, 2025 02:30:27

Dec 02, 2025 02:30:25

Dec 02, 2025 02:21:37