The cryptocurrency market five years ago was actually healthier than it is now

1월 28, 2026 22:53:23

Original Title: The Crypto Market was Much Healthier 5 Years Ago

Original Author: Jeff Dorman (Arca CIO)

Original Compilation: 深潮 TechFlow

Abstract:

Is the crypto market becoming increasingly dull? Arca's Chief Investment Officer Jeff Dorman points out that while the infrastructure and regulatory environment have never been stronger, the current investment climate is at its "worst ever."

He sharply criticizes the industry's leaders for their failed attempts to force cryptocurrencies into "macro trading tools," resulting in extreme correlation among various assets. Dorman calls for a return to the essence of "tokens as securities," focusing on quasi-equity assets like DePIN and DeFi that have cash flow generation capabilities.

In a time when gold is surging while Bitcoin remains relatively weak, this in-depth reflective article provides an important perspective for re-evaluating the investment logic of Web3.

Full Text:

Bitcoin is Facing an Unfortunate Situation

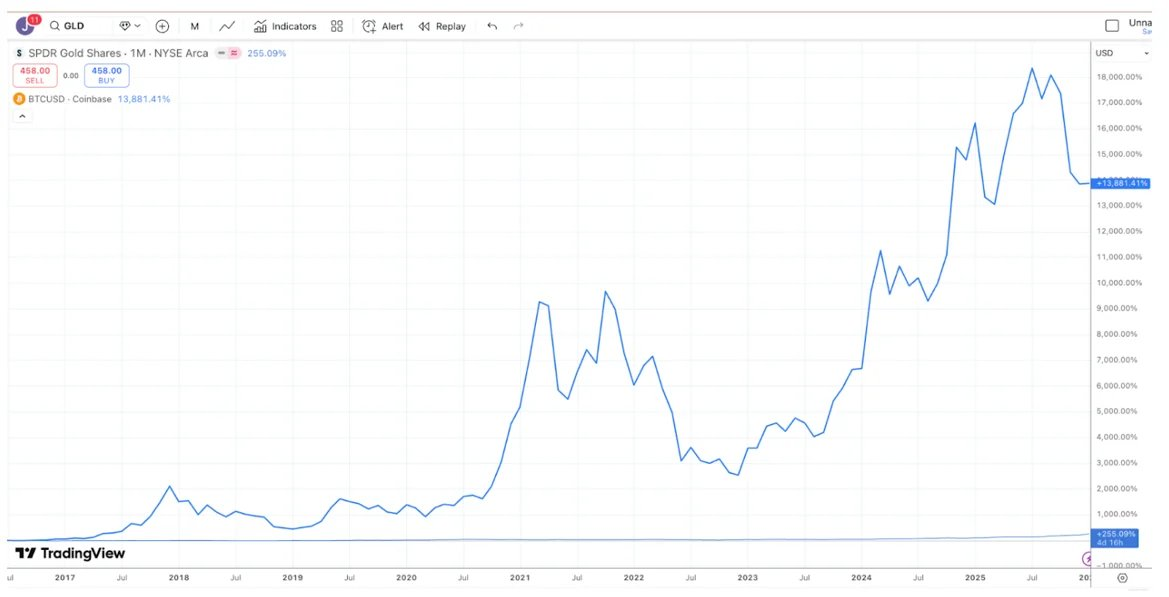

Most investment debates exist because people are operating on different time horizons, leading to frequent "talking past each other," even though both sides may technically be correct. Take the debate between gold and Bitcoin as an example: Bitcoin enthusiasts tend to argue that Bitcoin is the best investment because its performance has far outpaced gold over the past decade.

Caption: Source TradingView, comparison of returns between Bitcoin (BTC) and gold (GLD) over the past 10 years

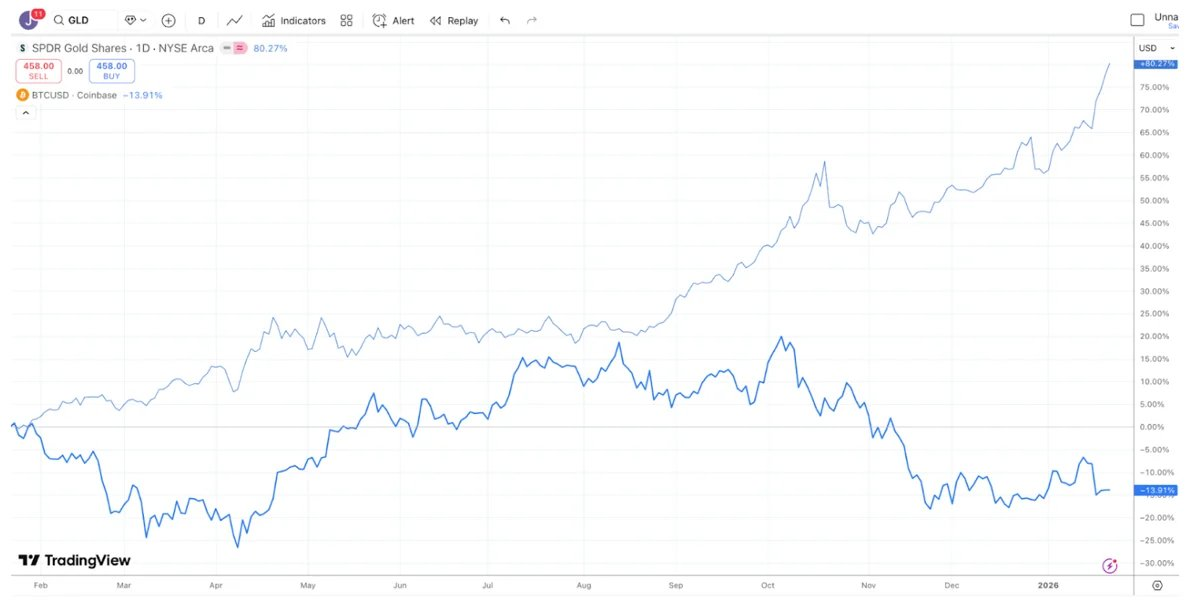

Gold investors, on the other hand, tend to believe that gold is the best investment and have recently been "mocking" Bitcoin's downturn, as gold has clearly outperformed Bitcoin over the past year (similar situations exist for silver and copper).

Caption: Source TradingView, comparison of returns between Bitcoin (BTC) and gold (GLD) over the past year

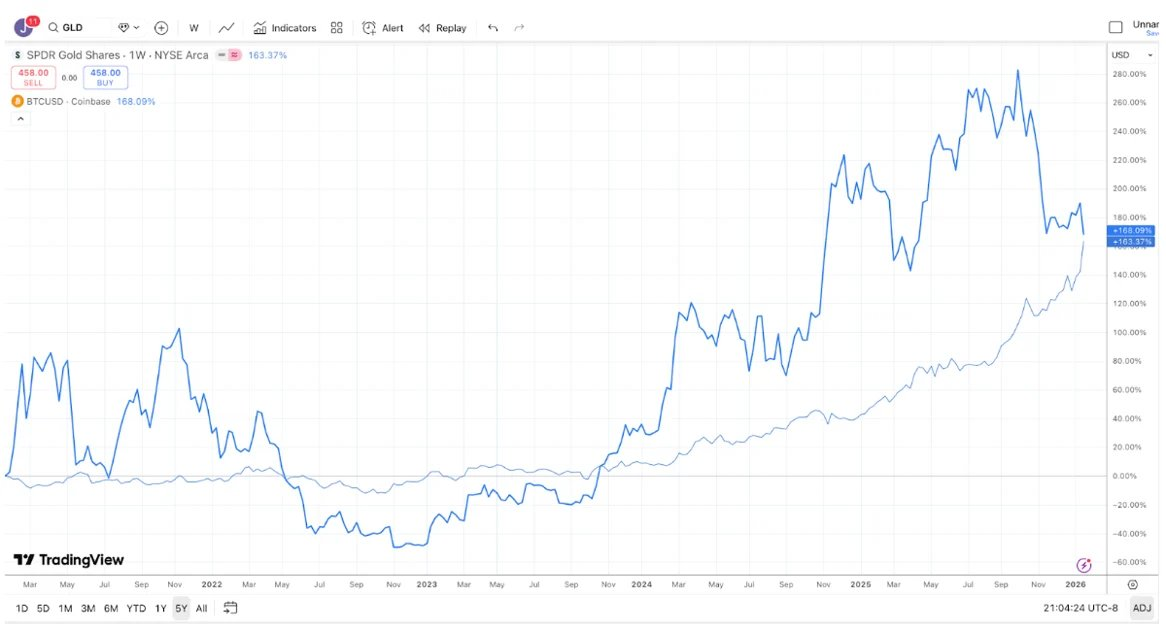

Meanwhile, over the past 5 years, the returns of gold and Bitcoin have been almost identical. Gold often remains stagnant for long periods, only to soar when central banks and trend followers buy in; Bitcoin tends to experience dramatic surges followed by significant crashes, but ultimately still trends upward.

Caption: Source TradingView, comparison of returns between Bitcoin (BTC) and gold (GLD) over the past 5 years

Thus, depending on your investment horizon, you can almost win or lose any debate about Bitcoin versus gold.

Even so, it is undeniable that recently gold (and silver) has shown strength relative to Bitcoin. To some extent, this is somewhat comical (or sad). The largest companies in the crypto industry have spent the last decade catering to macro investors rather than true fundamental investors, only for these macro investors to say, "Forget it, let's just buy gold, silver, and copper." We have long been calling for a shift in thinking within the industry. Currently, there are over 600 trillion dollars in entrusted assets, and the buyer base for these assets is much stickier. Many digital assets resemble bonds and stocks more closely, issued by companies that generate income and conduct token buybacks; however, for some reason, market leaders have chosen to ignore this token sub-industry.

Perhaps Bitcoin's recent poor performance relative to precious metals is enough to make large brokers, exchanges, asset management firms, and other crypto leaders realize that their attempts to turn cryptocurrencies into all-encompassing macro trading tools have failed. Instead, they may turn their attention to educating that $600 trillion pool of investors who prefer to buy cash-generating assets. For the industry, it is not too late to start focusing on quasi-equity tokens that embody cash-generating tech businesses (such as various DePIN, CeFi, DeFi, and token issuance platform companies).

That said, if you simply change the "finish line" position, Bitcoin is still king. So, the more likely scenario is that nothing will change.

The Differentiation of Assets

The "good days" of crypto investing seem like a distant memory. Back in 2020 and 2021, it felt like new narratives, sectors, or use cases, along with new tokens, emerged every month, with positive returns coming from all corners of the market. While the growth engine of blockchain has never been stronger (thanks to legislative progress in Washington, the growth of stablecoins, DeFi, and the tokenization of real-world assets), the investment environment has never been worse.

One sign of market health is dispersion and lower cross-market correlation. You certainly want the performance of healthcare and defense stocks to differ from that of tech and AI stocks; you also want emerging market stocks to behave independently of developed markets. Dispersion is generally seen as a good thing.

2020 and 2021 are largely remembered as a "rising tide" market, but that was not entirely the case. It was rare to see the entire market move in sync. More commonly, when one sector was up, another was down. When the gaming sector surged, DeFi might be declining; when DeFi was up, "dino-level" L1 tokens were down; when Layer-1 surged, the Web3 sector was down. A diversified crypto asset portfolio actually smoothed returns and typically reduced the overall portfolio's beta and correlation. Liquidity ebbed and flowed with interest and demand, but return performance was heterogeneous. This was very encouraging. It made sense that a lot of capital flowed into crypto hedge funds in 2020 and 2021 because the investable space was expanding and returns were diverse.

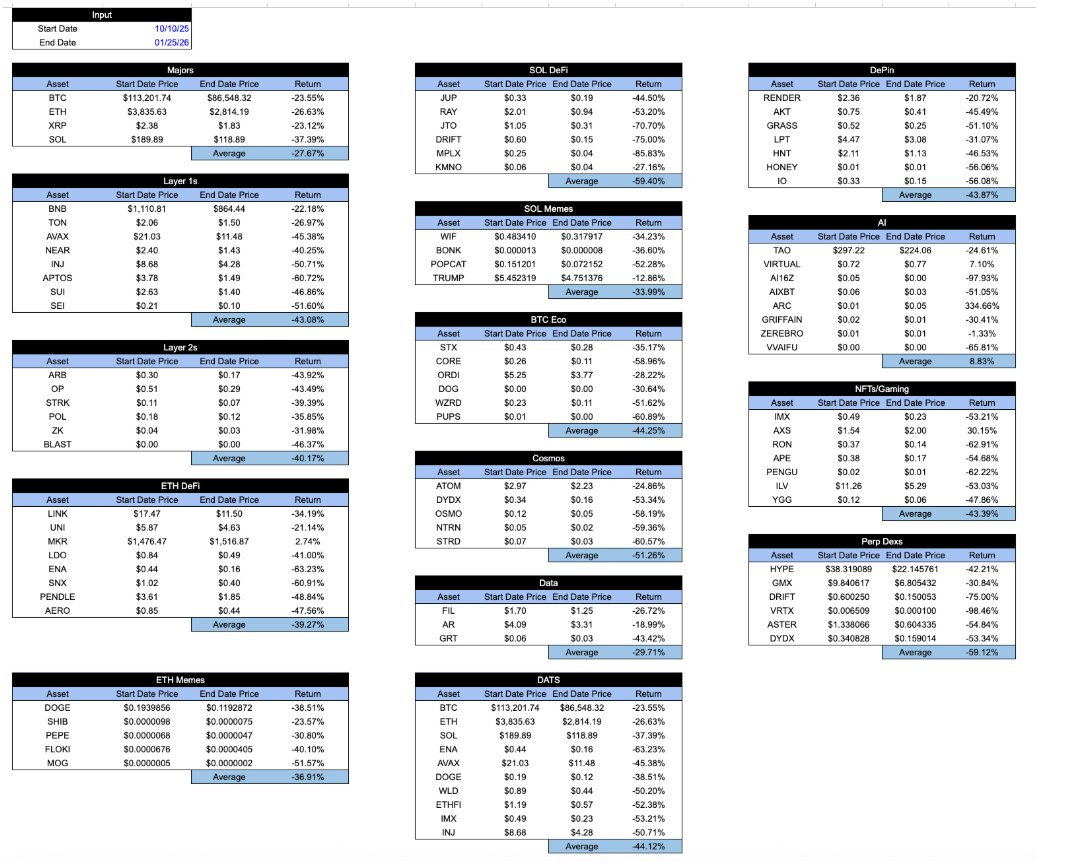

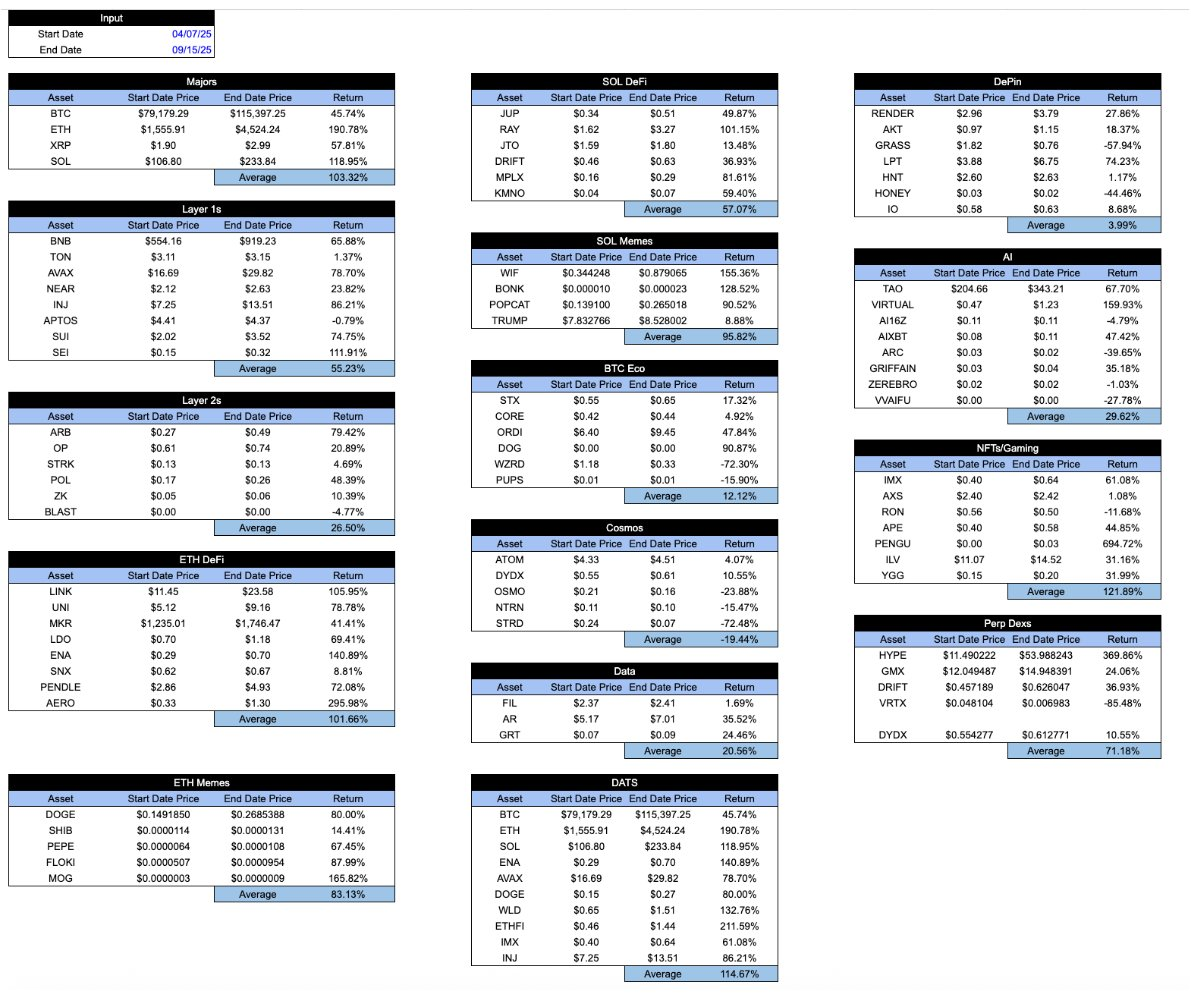

Fast forward to today, all assets "wrapped in crypto" seem to yield the same results. Since the flash crash on October 10, the declines across sectors have been nearly indistinguishable. No matter what you hold, how that token captures economic value, or how the project's development trajectory looks… the returns are largely the same. This is very frustrating.

Caption: Arca internal calculations and CoinGecko API data for representative crypto asset samples

In prosperous market times, this table would look somewhat more encouraging. "Good" tokens often outperform "bad" tokens. But a healthy system should actually be the opposite: you want good tokens to perform better even in bad times, not just when the market is good. Here is the same table from the low point on April 7 to the high point on September 15.

Caption: Arca internal calculations and CoinGecko API data for representative crypto asset samples

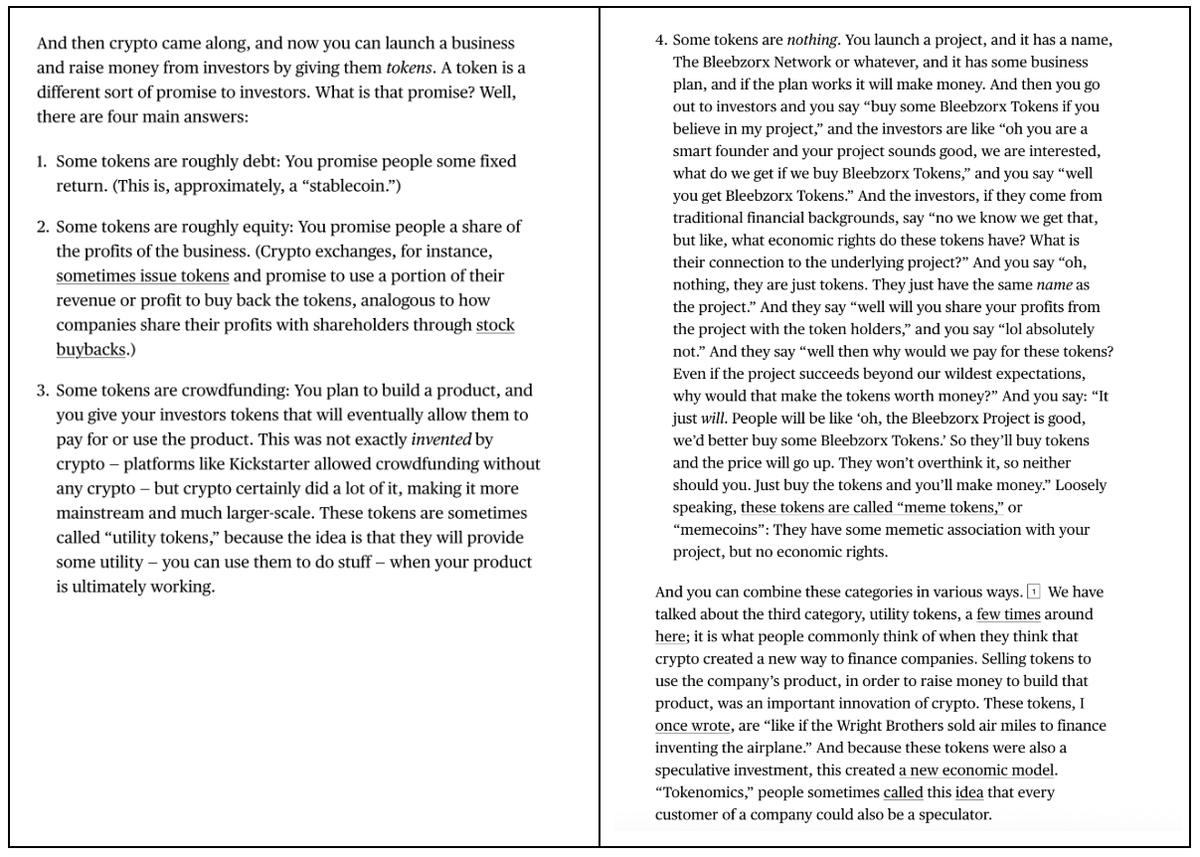

Interestingly, when the crypto industry was still in its infancy, market participants worked very hard to differentiate between different types of crypto assets. For instance, I published an article in 2018 where I categorized crypto assets into four types:

- Cryptocurrencies/money

- Decentralized protocols/platforms

- Asset-backed tokens

- Pass-through securities

At that time, this classification was quite unique and attracted many investors. Importantly, crypto assets were evolving from being merely Bitcoin to smart contract protocols, asset-backed stablecoins, and quasi-equity pass-through securities. Researching different growth areas was a primary source of alpha, as investors sought to understand the various valuation techniques required to assess different types of assets. Most crypto investors at that time were even unaware of when unemployment claims data was released or when FOMC meetings were held, and they rarely looked for signals from macro data.

After the crash in 2022, these different types of assets still exist. Essentially, nothing has changed. However, there has been a massive shift in the way the industry markets itself. Those "gatekeepers" have deemed Bitcoin and stablecoins as the only things that matter; the media has decided they don't want to write about anything other than TRUMP tokens and other memecoins. Over the past few years, not only has Bitcoin outperformed most other crypto assets, but many investors have even forgotten about the existence of these other asset types (and sectors). The underlying business models of companies and protocols have not become more relevant, but due to investor flight and market makers dominating price movements, the correlation of the assets themselves has indeed increased.

This is why Matt Levine's recent article about tokens is so surprising and popular. In just four short paragraphs, Levine accurately describes the differences and nuances between various tokens. This gives me some hope that such analysis is still viable.

Leading crypto exchanges, asset management firms, market makers, OTC platforms, and pricing service providers still refer to everything outside of Bitcoin as "altcoins," and they seem to only write macro research reports that bundle all "cryptocurrencies" together as one massive asset. Did you know that, for example, Coinbase seems to have only a very small research team led by a primary analyst (David Duong), whose focus is mainly on macro research? I have no issue with Mr. Duong—his analysis is excellent. But who would go to Coinbase just to see macro analysis?

Imagine if leading ETF providers and exchanges only vaguely wrote about ETFs, saying things like "ETFs are down today!" or "ETFs react negatively to inflation data." They would be laughed out of business. Not all ETFs are the same; just because they use the same "wrapper," those who sell and promote ETFs understand this. What matters is what is inside the ETF, and investors seem to be able to wisely differentiate between different ETFs, primarily because industry leaders have helped their clients understand this.

Similarly, tokens are just a "wrapper." As Matt Levine eloquently describes, what is inside the token is what matters. The type of token is important, the sector is important, and its attributes (inflation or amortization) are also important.

Perhaps Levine is not the only one who understands this. But he does a better job of explaining the industry than those who are truly profiting from it.

Click to learn about job openings at ChainCatcher

Recommended Reading:

After the premium reset, is it time for MSTR to enter?

Delphi Digital: What is the future direction of cryptocurrencies?

Pantera Capital Partner: The current state and future of internet capital markets

How did RedotPay reach a valuation of $2 billion in three years?

a16z in-depth article: How to correctly understand the threat of quantum computing to blockchain

Latest News

ChainCatcher

1월 30, 2026 22:30:48

ChainCatcher

1월 30, 2026 22:30:19

ChainCatcher

1월 30, 2026 22:27:02

ChainCatcher

1월 30, 2026 22:18:57

ChainCatcher

1월 30, 2026 22:10:56