Everyone loves Clawdbot, but I only care if my AI can actually trade

Feb 03, 2026 14:42:07

Author: Bill Sun

Compiled by: ChainCatcher

Now everyone is fascinated by Clawdbot -> Molty -> Openclaw. Screenshots like these are everywhere:

"Cleared my inbox while sleeping."

"Automatically scheduled a meeting."

"Completed research before having coffee."

It feels like Jarvis has finally arrived. But after using Openclaw and Claude Code for a while, I've realized something very clear: most AI agents currently provide emotional value rather than financial results.

They can think, analyze, explain, and then… just stop. Because when it comes to actually mobilizing funds, humans remain the bottleneck.

The Real Problem No One Wants to Admit

Openclaw can tell you:

"Meta's sentiment is reversing."

"NVDA's (NVIDIA) volatility is mispriced."

"TSLA's (Tesla) momentum is about to break out."

But what happens next? You might be busy with other things, with no time to open brokerage accounts like Charles Schwab to click "trade." By the time you click, the excess returns (Alpha) have already vanished.

The experience of trading tokenized assets is even more fragmented. Assets are spread across different chains, and you have to:

Open multiple wallets.

Figure out where the liquidity is.

Bridge across chains.

Deal with gas fees, slippage, and execution timing.

Manually set risk controls.

The bottleneck is not intelligence, but execution. AI has a brain but no hands.

When We Stop "Asking" and Start "Commanding"

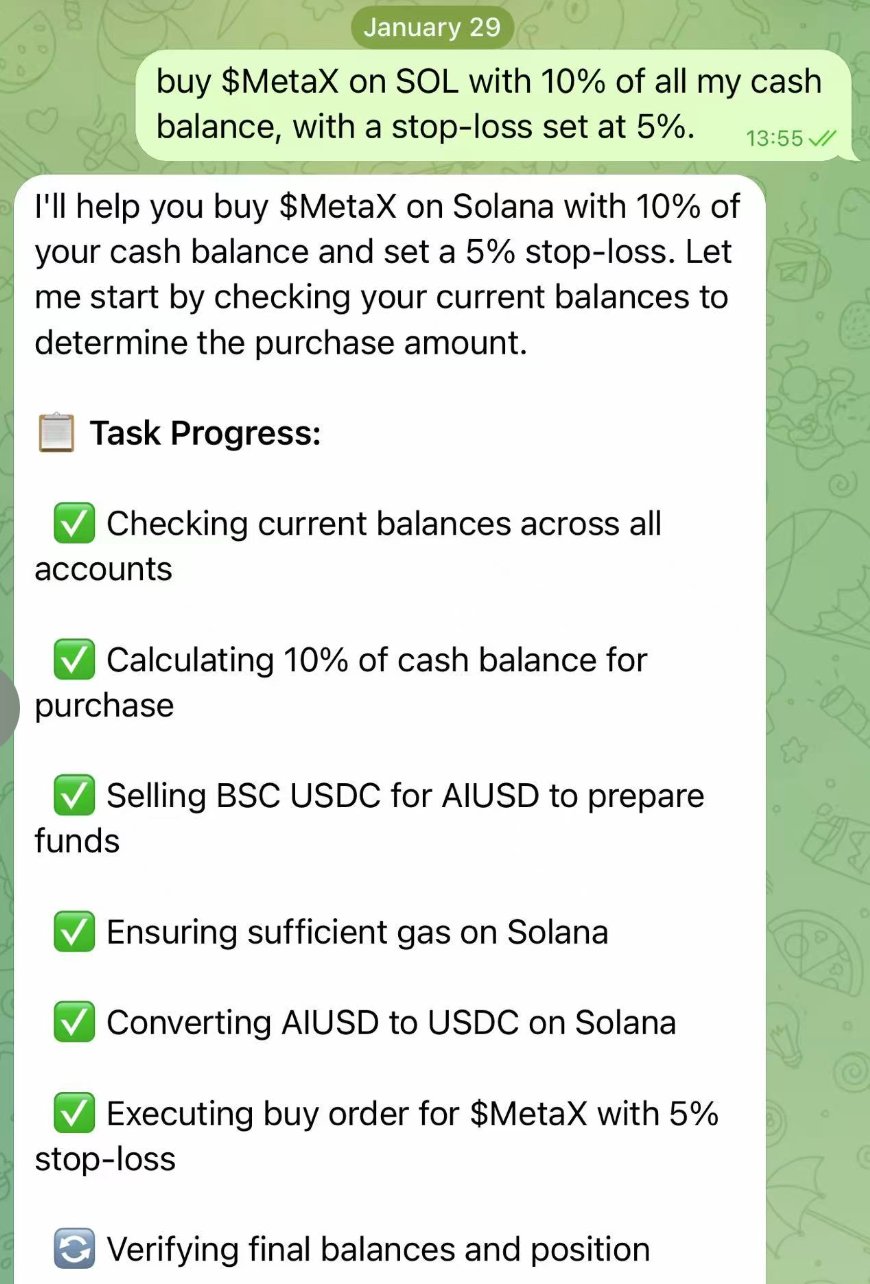

I no longer seek advice from AI; instead, I start giving it intent. No longer asking "What do you think?" but commanding "Do this."

For example:

"Allocate idle funds to NVDA exposure."

"Automatically reduce risk if volatility spikes."

"Switch configurations if TSLA breaks the trend."

This is where AIUSD opened my eyes. It's like I hired a trader sitting in the room, monitoring the market 24/7, waiting for my commands, executing immediately through smart order routing and minimizing trading impact.

Real Case: Meta vs Gold (Tokenized Assets Executed by Agent)

This is a simple yet powerful scenario. We ran an Openclaw agent powered by Claude Opus 4.5, tasked with: monitoring NVDA, TSLA, Meta, BTC, gold, and silver for earnings-driven volatility.

The agent detected on January 29:

Meta has a strong continuation potential post-earnings.

Gold and silver show higher downside volatility and headline risk.

Considering the on-chain liquidity of tokenized assets and the current portfolio, the agent decided: "Reduce exposure to tokenized gold (PAXG) and rotate funds into tokenized Meta."

The process executed using AIUSD:

Aggregate funds spread across various EVM chains.

Automatically reduce PAXGOLD on Ethereum.

Convert to a unified funding layer.

Buy tokenized Meta on Solana.

Attach downside protection at the execution level.

No need to switch apps, no cross-chain hassles, no late-night manual operations. The agent didn't notify me; it completed the reallocation directly.

Why Tokenized Stocks Change Everything

This is evident five years after the GameStop incident. The failure in 2021 was not due to retail investors, but because of infrastructure. The market changes in real-time, but settlement does not.

Robinhood CEO Vlad Tenev recently wrote: "Real-time markets need real-time settlement." This means tokenization.

Advantages of Tokenized Stocks:

Instant settlement.

24/7 trading.

Machine-readable.

Can be executed directly by agents without intermediaries.

This is no longer an ideology of cryptocurrency but financial physics.

AI Agents and Tokenization Are Inseparable

Operational Characteristics of AI Agents: Continuous, global, emotionless, zero tolerance for latency.

Operational Characteristics of Traditional Finance: Time-limited trading, delayed settlement, manual intervention required at every step.

These two systems are incompatible. Tokenized assets are the only tools that can move at machine speed, be programmed, and be fully delegated to agents.

The Mission of AIUSD

AIUSD does not want to be just a better trading app. We are building the monetary layer for AI agents:

Fund unification.

Execution abstraction.

Risk programmatic.

Agent end-to-end action.

Openclaw proves that AI can think; tokenization makes the market machine-native; AIUSD is responsible for connecting the two.

In the age of AI, Alpha does not belong to the smartest humans, but to those who hand over control of funds to machines.

Welcome to the official ChainCatcher community

Telegram Subscription: https://t.me/chaincatcher;

Official Twitter Account: https://x.com/ChainCatcher_

Latest News

ChainCatcher

2월 04, 2026 00:44:04

ChainCatcher

2월 04, 2026 00:27:26

ChainCatcher

2월 04, 2026 00:23:10

ChainCatcher

2월 04, 2026 00:19:12

ChainCatcher

2월 04, 2026 00:09:06